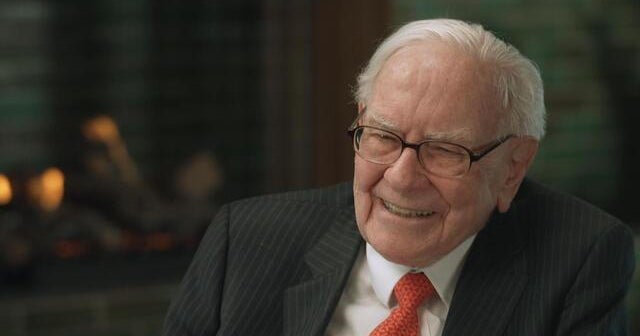

How Warren Buffett Defies Market Turmoil: The Secrets Behind His Growing Wealth

Warren Buffett, the 93-year-old billionaire investor and CEO of Berkshire Hathaway, continues to amass wealth despite global market volatility, trade wars, and economic uncertainty. His net worth, now exceeding $120 billion, reflects a disciplined investment strategy that prioritizes long-term value over short-term gains. By focusing on fundamentally strong companies like Apple, Bank of America, and Coca-Cola—while cautiously navigating high-growth sectors like electric vehicles and tech—Buffett’s portfolio remains resilient. Analysts credit his success to patience, contrarian bets, and an unwavering commitment to his “buy and hold” philosophy.

The Buffett Blueprint: Time-Tested Strategies in a Volatile Market

Buffett’s approach to investing is often summarized as “being fearful when others are greedy and greedy when others are fearful.” This mindset has allowed him to capitalize on market downturns, such as the 2008 financial crisis, where he invested billions in distressed but fundamentally sound companies. Recent filings reveal that Berkshire Hathaway holds over $350 billion in equities, with significant stakes in:

- Apple (40% of portfolio): A cornerstone investment since 2016, now worth roughly $160 billion.

- Bank of America (10%): A bet on the enduring strength of the U.S. financial system.

- Amazon and Tesla (smaller positions): Though historically skeptical of tech, Buffett acknowledges their disruptive potential.

“Buffett’s genius lies in his ability to ignore noise and focus on cash flow,” says financial analyst Rebecca Collins. “While others chase trends, he looks for companies with durable competitive advantages—what he calls ‘moats.'”

Tariff Wars and Global Uncertainty: Why Buffett Stays Unshaken

Despite escalating trade tensions between the U.S. and China, Buffett’s investments in multinational corporations have shielded his wealth. For instance, Coca-Cola derives nearly 60% of its revenue overseas, while Apple’s supply chain diversification mitigates tariff risks. “Global brands adapt,” Buffett remarked at a 2023 shareholder meeting. “The world still wants iPhones and soft drinks, regardless of politics.”

Data supports his optimism: Berkshire’s Q2 2023 earnings rose 6.7% year-over-year, with insurance and energy holdings (like Geico and Berkshire Hathaway Energy) providing steady cash flow. Meanwhile, his avoidance of speculative assets like cryptocurrencies has spared him from recent market wipeouts.

Tech Titans and Tesla: Buffett’s Cautious Foray into Disruption

Though Buffett traditionally favored “old economy” stocks, Berkshire’s stakes in Amazon and Tesla signal a nuanced shift. While he hasn’t embraced tech as aggressively as peers like Cathie Wood, his team—notably investment managers Todd Combs and Ted Weschler—has spearheaded selective bets. Tesla, for example, represents less than 1% of Berkshire’s portfolio, reflecting Buffett’s caution toward Elon Musk’s volatile leadership.

“Buffett respects innovation but demands profitability,” notes tech economist Mark Harrison. “Amazon fits his criteria—dominant market share, recurring revenue—whereas Tesla’s valuation puzzles him.”

Critics and Challenges: Is Buffett’s Strategy Outdated?

Some argue that Buffett’s aversion to high-growth tech stocks has cost him. Berkshire underperformed the S&P 500 in five of the past 10 years, and his reluctance to invest early in companies like Google or Meta led to missed opportunities. “The game has changed,” contends hedge fund manager David Lin. “Buffett’s principles work, but they’re not optimized for the digital age.”

Yet, Buffett’s defenders highlight his risk-adjusted returns. During the 2022 market crash, Berkshire lost only 8% compared to the S&P 500’s 19% drop—a testament to his emphasis on stability.

The Future of Buffett’s Empire: Succession and Sustainability

With Buffett nearing his mid-90s, questions loom over Berkshire’s future. Vice chairs Greg Abel and Ajit Jain are poised to take the helm, but replicating Buffett’s intuition will be tough. Meanwhile, Berkshire’s $130 billion cash pile suggests major acquisitions loom, potentially in energy or infrastructure.

“The next decade will test whether Buffett’s philosophy is timeless or tied to his unique instincts,” says Collins. “But for now, his playbook still works.”

Key Takeaways for Investors

Buffett’s resilience offers lessons for navigating turbulence:

- Prioritize quality: Invest in companies with strong balance sheets and competitive edges.

- Think long-term: Avoid reactive trading based on headlines.

- Diversify cautiously: Balance high-growth bets with stable, cash-generating assets.

For those seeking to emulate his success, studying Berkshire’s annual reports—and practicing patience—is a solid start. As Buffett himself says, “The stock market is a device for transferring money from the impatient to the patient.”

Want to dive deeper into value investing? Explore Berkshire Hathaway’s latest shareholder letters here for firsthand insights.

See more CNBC Network