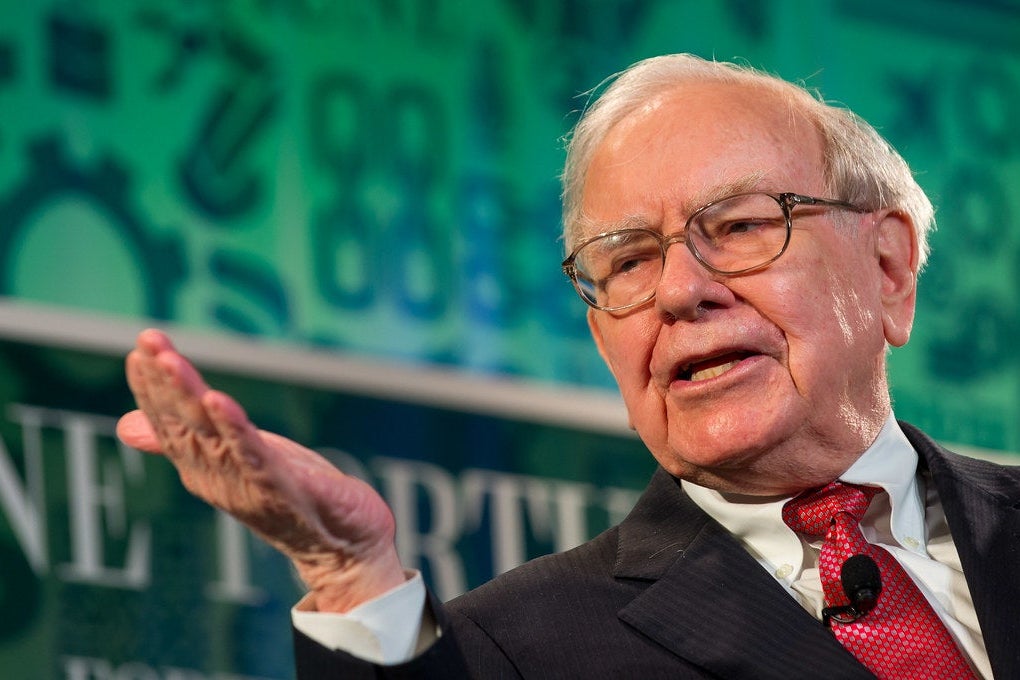

Warren Buffett, one of the most successful investors of all time, has long been a source of wisdom for those navigating the complex world of financial markets. One of his most famous warnings was regarding an economic indicator that he described as “playing with fire” when it surpasses 140%. This indicator, which measures the ratio of total market capitalization to GDP, has now surged past 200%, leaving investors to wonder: is a market crisis imminent? As this key metric reaches unprecedented levels, it prompts a deeper exploration of its implications, potential risks, and broader market trends.

Understanding Buffett’s “Playing With Fire” Indicator

The indicator in question is known as the Market Capitalization-to-GDP ratio, often referred to as the “Buffett Indicator.” This ratio is calculated by dividing the total market capitalization of all publicly traded companies by the country’s gross domestic product (GDP). Buffett has long viewed this as a simple but powerful gauge of whether the stock market is overvalued or undervalued relative to the overall economy.

Historically, when this ratio is significantly higher than its long-term average, it suggests that the market may be in a speculative bubble, with stocks potentially overvalued. Conversely, a lower ratio signals undervaluation and potential buying opportunities. Buffett has stated that when the ratio exceeds 140%, it is like “playing with fire,” warning that it could lead to a market correction or downturn. However, the current surge beyond 200% raises new concerns about a potential market crisis.

The Current State of the Market Capitalization-to-GDP Ratio

As of late 2024, the Market Capitalization-to-GDP ratio has surged past the 200% mark, far exceeding Buffett’s threshold of caution. This dramatic rise has sparked alarm among investors, especially those who are wary of the growing disparity between market valuations and economic fundamentals.

To put this in perspective, the ratio typically hovers between 70% and 100% during stable market conditions. A level above 140% historically signals heightened risk, while anything above 200% is considered extreme. In fact, the last time the ratio reached these levels was during the dot-com bubble of the late 1990s, followed by a sharp market correction in 2000. More recently, the ratio hit similar highs before the 2008 financial crisis, though not to the same extreme degree.

What Does This Indicator Really Signal?

While the Market Capitalization-to-GDP ratio is an important signal, it is not always a perfect predictor of market crashes. The indicator reflects broad market trends, but it does not account for all variables that influence stock prices. In fact, many argue that this ratio alone cannot fully capture the complexities of the current market environment. To better understand the significance of the current surge, it’s important to consider several factors that could influence the market dynamics in 2024 and beyond.

Factors Contributing to the High Ratio

- Low Interest Rates: Since the 2008 financial crisis, central banks around the world, including the Federal Reserve, have kept interest rates at historically low levels. This has made borrowing cheaper, incentivizing investment in equities and driving up stock prices.

- Technological Boom: The rapid growth of the technology sector, particularly in areas like artificial intelligence, biotechnology, and electric vehicles, has contributed significantly to rising market valuations. Companies like Apple, Microsoft, and Tesla have become behemoths, pushing up the overall market capitalization.

- Quantitative Easing (QE): The continued use of QE by central banks has flooded the markets with liquidity, further inflating asset prices, including stocks. The influx of capital has led to a disconnect between the stock market and broader economic indicators.

- Global Supply Chain Disruptions: The COVID-19 pandemic and its aftermath have led to disruptions in supply chains, affecting production and consumption. While this has impacted GDP growth in many countries, it has also contributed to stock price volatility.

The Role of Institutional Investors and Retail Traders

The dynamics of the modern stock market are also influenced by the rise of retail traders and the increasing participation of institutional investors. The proliferation of online trading platforms and the popularity of investment strategies such as passive index investing have driven significant capital into the market, further inflating stock prices. In particular, the growth of exchange-traded funds (ETFs) has made it easier for retail investors to gain exposure to the broader market, which may explain part of the high valuation levels.

Market Resilience: Will History Repeat Itself?

Despite the warnings raised by Buffett and others, it’s important to note that high valuations do not always result in market crashes. In some cases, markets can remain overvalued for extended periods without experiencing a significant downturn. For example, during the 2010s, the stock market continued to climb even as valuations were considered elevated, thanks in part to the long economic expansion fueled by technological innovation and cheap credit.

Moreover, the market’s resilience in the face of economic disruptions, such as the global pandemic, suggests that traditional valuation metrics might not always apply in today’s rapidly changing environment. The rise of new technologies, geopolitical uncertainties, and government intervention through fiscal and monetary policies could mitigate some of the risks associated with high valuations.

Global Economic and Geopolitical Factors

In addition to domestic economic policies, global factors also play a critical role in shaping market conditions. Tensions in geopolitical hotspots, such as the ongoing conflict in Ukraine, the trade policies between the United States and China, and the economic policies of emerging markets, all have the potential to influence investor sentiment and market stability.

Furthermore, global supply chain issues and inflationary pressures may continue to impact the broader economy, leading to a slow but steady decoupling between stock market performance and GDP growth. In this context, even if the Market Capitalization-to-GDP ratio appears extreme, it may be influenced by broader, more complex factors that aren’t immediately reflected in traditional economic indicators.

Implications for Investors: What Should You Do?

Given the current state of the market, investors should approach the situation with caution. While the surge in the Market Capitalization-to-GDP ratio signals potential risks, it doesn’t necessarily mean that a market crash is imminent. However, the current environment calls for careful portfolio management and a balanced approach to risk.

- Diversification: Ensuring that your portfolio is well-diversified across different asset classes (stocks, bonds, commodities, real estate) can help mitigate the risks of a downturn.

- Focus on Value: With markets potentially overheated, investors may want to focus on value stocks rather than growth stocks. These companies tend to be undervalued relative to their fundamentals and may offer more stability in times of market volatility.

- Monitor Economic Data: Keep an eye on economic indicators such as GDP growth, inflation, and employment figures, as well as central bank policies. These can provide insight into the broader health of the economy and the likelihood of a market correction.

- Long-Term Perspective: While short-term market fluctuations can be unsettling, long-term investors should maintain a focus on their investment goals and avoid making panic-driven decisions.

The surge in the Market Capitalization-to-GDP ratio past 200% is a clear signal that the market is entering uncertain territory. While this level of overvaluation could indicate a heightened risk of a market correction, it is not a guarantee of an imminent crisis. The factors driving this phenomenon are multifaceted, and the outcome will depend on a range of economic, technological, and geopolitical developments.

For investors, the key takeaway is to remain vigilant and adaptable. By diversifying portfolios, staying informed about macroeconomic trends, and taking a long-term view, investors can better navigate the challenges posed by high market valuations and uncertain global conditions. The wisdom of Warren Buffett remains as relevant as ever, but it is also important to recognize that today’s market dynamics are more complex than ever before.

For more insights on market trends and investment strategies, visit Investopedia.

Additionally, to explore the latest economic updates, check out Bloomberg Economics.

See more CNBC Network