The Crisis of Confidence: Unraveling the US Treasuries Sell-Off

For decades, US Treasuries have been the bedrock of global finance—considered the safest of safe-haven assets. Yet, as yields surge and prices plummet in a historic sell-off, investors are questioning this long-held assumption. The shift, driven by soaring inflation, aggressive Federal Reserve policies, and geopolitical tensions, signals a potential transformation in the $24 trillion Treasury market with far-reaching consequences for economies worldwide.

Why the Treasury Market Is Under Pressure

The sell-off gained momentum in 2023 as 10-year Treasury yields climbed to 16-year highs, breaching 5% in October. This surge reflects a perfect storm of factors:

- Inflation and Fed Policy: The Federal Reserve’s aggressive rate hikes—525 basis points since March 2022—diminished the appeal of existing low-yield bonds.

- Supply Glut: The US Treasury issued $1.7 trillion in new debt in Q3 2023 alone, overwhelming demand.

- Geopolitical Shifts: Nations like China reduced holdings by $300 billion since 2021, diverting reserves to gold and alternatives.

“This isn’t just a cyclical downturn—it’s a structural reassessment of risk,” says Dr. Elena Rodriguez, chief economist at Horizon Capital Advisors. “When even Treasuries lose their luster, the entire global financial architecture trembles.”

The Domino Effect on Global Markets

The repercussions extend beyond Wall Street. Rising Treasury yields have:

- Increased borrowing costs for governments and corporations, pushing the global debt burden to $307 trillion (IIF data).

- Triggered volatility in equities, with the S&P 500 shedding 8% between August and October 2023.

- Strengthened the US dollar, exacerbating emerging-market currency crises.

Meanwhile, traditional buyers like Japan and pension funds face mounting losses. “The ‘buy-and-hold’ strategy is broken,” notes hedge fund manager David Kessler. “At these yield levels, duration risk is a ticking time bomb.”

Is the Safe-Haven Status at Risk?

While Treasuries remain the world’s deepest liquid market, cracks are emerging. A 2023 BofA survey revealed 28% of institutional investors now view gold as a safer hedge than US debt—up from 12% in 2020. Alternatives gaining traction include:

- Eurozone bonds (despite their own challenges)

- Cryptocurrencies like Bitcoin, dubbed “digital gold”

- Infrastructure and real assets

Yet, not all analysts sound the alarm. “Treasuries still dominate because there’s no alternative with comparable scale,” argues MIT economist Prof. Samuel Greene. “The sell-off is painful but temporary.”

What Lies Ahead for Investors?

The path forward hinges on three variables:

- Fed Policy: A pivot to rate cuts could stabilize prices, but stubborn inflation may prolong the pain.

- Foreign Demand: Will China and Japan resume buying, or is diversification permanent?

- Fiscal Discipline: US debt-to-GDP nearing 120% raises default fears, albeit distant.

For now, investors are advised to:

- Diversify into TIPS (inflation-protected securities) and short-duration bonds

- Monitor central bank rhetoric for policy clues

- Reassess portfolio risk exposure quarterly

As the dust settles, one truth emerges: the era of unconditional faith in US Treasuries may be ending. In this new landscape, vigilance and adaptability are paramount. For real-time insights, subscribe to our market newsletter or consult a certified financial advisor.

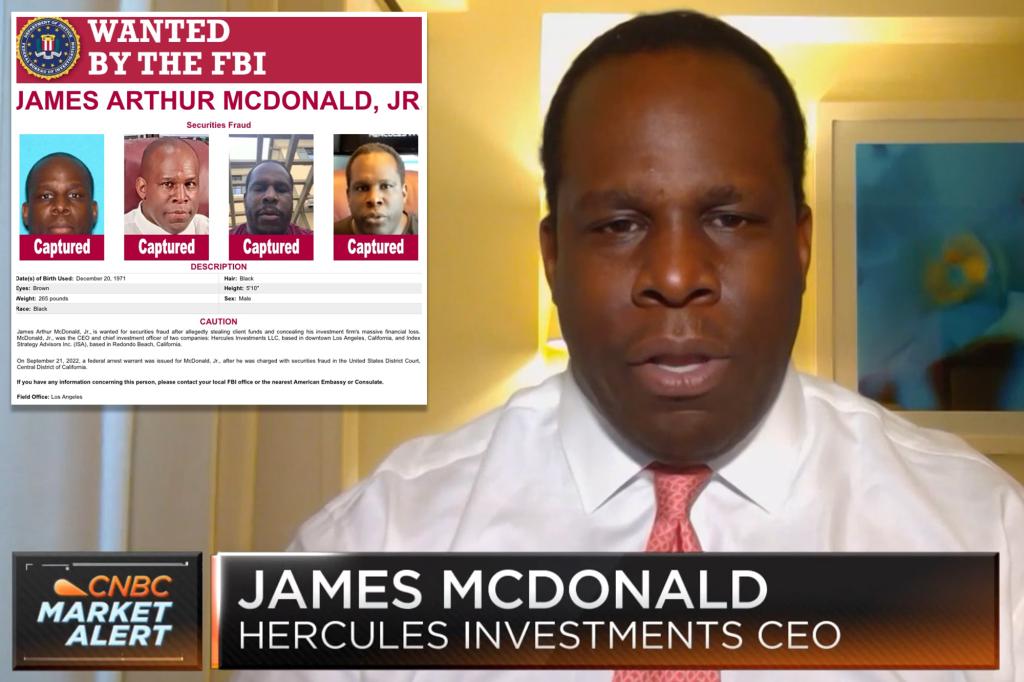

See more CNBC Network