Strategic Stock Maneuvers: Understanding Profit-Taking and Reinvestment Insights

In the ever-evolving landscape of financial markets, investors continuously seek strategies that maximize returns while minimizing risks. Among these strategies, two critical maneuvers stand out: profit-taking and reinvestment. As market dynamics shift, savvy investors are reassessing their positions in various stocks, with a keen focus on when to take profits and when to reinvest. This article delves into the rationale behind profit-taking in one notable stock and the decision to reinvest in another, providing insights that can benefit both novice and seasoned investors alike.

The Art of Profit-Taking

Profit-taking is a fundamental strategy employed by investors to lock in gains after a stock has appreciated in value. This practice is crucial for mitigating risk and ensuring that profits are realized rather than left to the whims of market fluctuations. But when is the right time to take profits?

Identifying the Right Moment

Timing is everything in the stock market. Here are some key indicators that suggest it might be time to consider profit-taking:

- Target Price Achieved: Investors often set target prices based on fundamental analysis. When a stock reaches this target, it may be prudent to take profits.

- Market Sentiment Shift: A change in market sentiment, such as rising interest rates or economic uncertainty, can prompt profit-taking to avoid potential losses.

- Overvaluation Concerns: If a stock’s price-to-earnings ratio significantly exceeds its historical average or industry peers, it may be time to cash out.

- Significant News Events: Company announcements, earnings reports, or geopolitical events can influence stock prices. Positive news may provide an exit opportunity, while negative news could signal a downturn.

Understanding these indicators can help investors make informed decisions about when to take profits. For instance, a recent analysis of a tech stock that surged over 200% in the past year suggests that many investors are now considering profit-taking due to concerns over market saturation and increasing competition.

Reinvestment: The Path to Growth

While profit-taking is a vital strategy, reinvestment is equally important for those looking to grow their portfolios. Reinvesting profits into other promising stocks or sectors can help capitalize on market opportunities. But how do investors decide where to reinvest?

Evaluating Reinvestment Opportunities

When considering reinvestment, investors should analyze several factors:

- Sector Performance: Some sectors may outperform others due to economic trends. For example, renewable energy stocks have gained traction as global demand for sustainable solutions increases.

- Company Fundamentals: Investors should assess a company’s financial health, including its revenue growth, profit margins, and debt levels, to determine its viability as a reinvestment candidate.

- Market Trends: Keeping an eye on emerging trends can help investors identify stocks that are poised for growth. For instance, the rise of artificial intelligence and machine learning has led many to reinvest in technology companies focused on these areas.

- Valuation Metrics: Evaluating a stock’s intrinsic value compared to its current market price is crucial. Stocks that appear undervalued can be excellent candidates for reinvestment.

As an example, an investor might choose to reinvest profits from a well-performing stock into a biotech firm that recently received FDA approval for a groundbreaking treatment. This decision may be based on the strong fundamentals and promising future growth prospects of the biotech sector.

Balancing Profit-Taking and Reinvestment

Finding the right balance between profit-taking and reinvestment is key to a successful investment strategy. Here are some tips for achieving this balance:

- Set Clear Goals: Establish your investment objectives—whether for short-term gains or long-term growth. This will guide your decisions on when to take profits and where to reinvest.

- Diversify Your Portfolio: Spread your investments across various sectors and asset classes to reduce risk and enhance potential returns. This diversification allows for more strategic profit-taking and reinvestment opportunities.

- Stay Informed: Regularly review market conditions, economic indicators, and company news to make informed decisions about profit-taking and reinvestment.

- Practice Disciplined Investing: Avoid emotional decision-making. Stick to your investment strategy and resist the temptation to react impulsively to market fluctuations.

Conclusion: Navigating the Investment Landscape

Strategic stock maneuvers, particularly profit-taking and reinvestment, are essential skills for navigating the complex world of investing. By understanding the indicators that signal the right time to take profits and evaluating potential reinvestment opportunities, investors can enhance their portfolio performance.

As market dynamics shift, the ability to adapt and make informed decisions becomes increasingly important. Whether it’s taking profits from a high-flying stock or reinvesting in a promising startup, these strategies can help investors achieve their financial goals. By continuously educating themselves and remaining vigilant, investors can turn market challenges into opportunities for growth.

In summary, the dance between profit-taking and reinvestment is a critical component of a successful investment strategy. With the right insights and a disciplined approach, investors can navigate the market’s ups and downs, ultimately leading to financial prosperity.

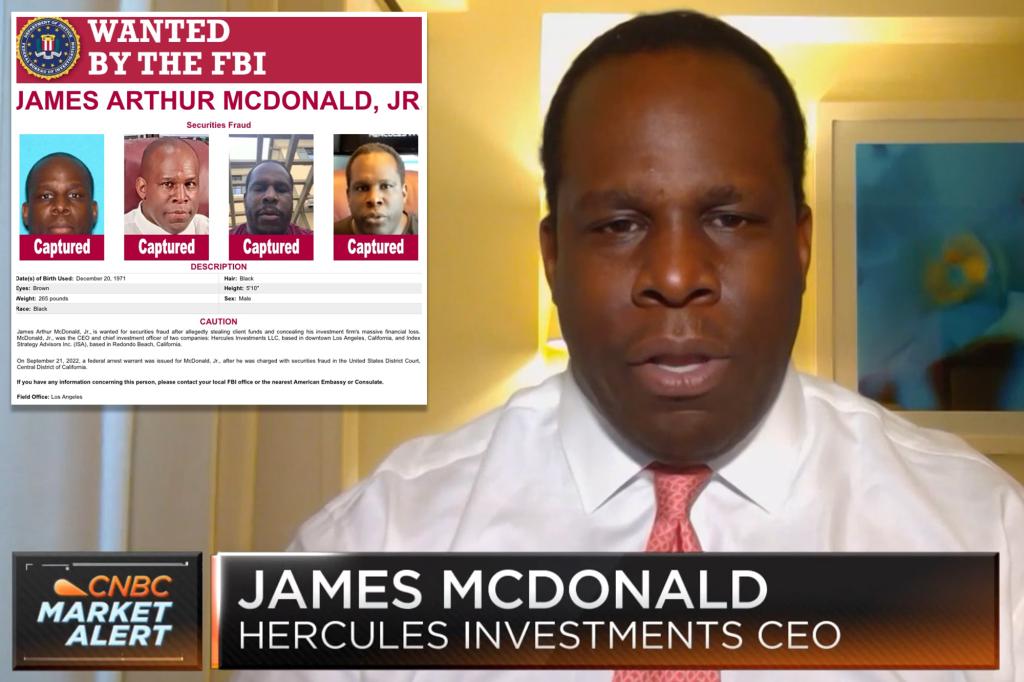

See more CNBC Network