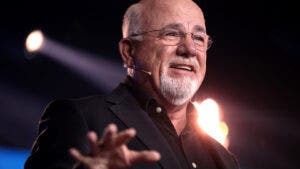

In recent years, discussions about the United States’ national debt have sparked heated debates across political, economic, and financial circles. Many economists and financial experts have warned that the country’s ballooning debt could lead to an inevitable financial crisis. However, financial guru Dave Ramsey has consistently challenged these dire predictions, arguing that they fail to account for the complex realities of the global economy. This article explores Ramsey’s perspective on the national debt, the broader implications for investors, and why he believes these economic doomsayers have repeatedly been wrong.

The National Debt Crisis: Myth or Reality?

The United States currently holds a national debt of over $33 trillion, a staggering figure that has prompted frequent predictions of impending economic collapse. Critics argue that this unsustainable level of debt will eventually lead to inflation, higher interest rates, and a collapse in the value of the U.S. dollar. These warnings have led to a sense of urgency among politicians and policymakers to address the debt crisis, but are these predictions grounded in reality? Financial expert Dave Ramsey, known for his no-nonsense approach to personal finance, argues that the economic doomsday scenario surrounding national debt is often overstated.

Dave Ramsey’s Stance on National Debt

Dave Ramsey’s view is clear: while the national debt is a serious issue, it is not an immediate threat to the U.S. economy. Ramsey points out that the fear surrounding the national debt is not new and that many past predictions about economic collapse have failed to materialize. For instance, during the 1980s and early 1990s, many experts warned that the rising debt would lead to runaway inflation and a crippling recession. Yet, the U.S. economy experienced robust growth during the same period.

According to Ramsey, much of the anxiety surrounding the national debt stems from a misunderstanding of how the U.S. government finances its obligations. As he explains, the United States has the unique ability to print its own currency and borrow in its own currency, making it less susceptible to the same debt pressures that affect other countries. The U.S. Treasury bond market remains one of the most stable and trusted investment vehicles in the world, and investors continue to buy U.S. debt in massive quantities.

The Real Dynamics Behind the U.S. Debt

To understand Ramsey’s position, it’s essential to examine the dynamics that influence the U.S. national debt. The U.S. government finances its debt primarily by issuing Treasury bonds, bills, and notes. These instruments are backed by the full faith and credit of the U.S. government, which remains a powerful assurance for global investors.

The U.S. government has historically run budget deficits, but these deficits have been offset by growth in the economy, higher tax revenues, and the ability to manage the debt efficiently. Debt-to-GDP (Gross Domestic Product) ratio is a key measure used by economists to gauge the sustainability of national debt. According to the U.S. Congressional Budget Office (CBO), the country’s debt-to-GDP ratio has been higher than 100% in recent years, but it remains manageable due to the strong position of the U.S. dollar as the world’s reserve currency.

Global Confidence in U.S. Debt

One of the key factors that has allowed the U.S. to sustain such a high level of national debt is the global demand for U.S. Treasury securities. These bonds are seen as a safe haven for investors, especially during times of global uncertainty. The U.S. Treasury bond market is the largest and most liquid bond market in the world, and it continues to attract both domestic and international buyers. This consistent demand helps keep interest rates relatively low, despite the rising levels of debt.

The dominance of the U.S. dollar in global trade and finance further strengthens the country’s ability to manage its debt. As the primary reserve currency used in international transactions, the dollar enjoys unparalleled liquidity and stability, allowing the U.S. government to issue more debt without facing the same risks that other countries might experience when borrowing.

The Economic Impact of Debt: A Closer Look

Despite Ramsey’s argument that the national debt is not an immediate threat to the economy, it is essential to consider the long-term implications of rising debt levels. While the U.S. may not face an economic collapse in the near future, the mounting debt could eventually lead to several challenges:

- Higher Interest Payments: As the national debt increases, so do interest payments. In fiscal year 2023, the U.S. spent over $500 billion on interest payments alone. This figure is expected to grow significantly in the coming years, potentially crowding out spending on other critical programs.

- Reduced Fiscal Flexibility: High levels of debt reduce the government’s ability to respond to economic crises. In times of recession or other economic shocks, the government typically resorts to stimulus spending, but a heavily indebted government has less room to maneuver.

- Potential for Inflationary Pressures: Although Ramsey argues that the U.S. is not at immediate risk, an uncontrolled increase in the money supply could eventually lead to inflation. Inflation can erode the value of savings and increase the cost of living, which affects everyday consumers and investors.

The Role of the Federal Reserve

The Federal Reserve plays a crucial role in managing the U.S. economy and addressing concerns related to national debt. Through its monetary policy, the Fed can adjust interest rates and use tools like quantitative easing to influence economic conditions. The Federal Reserve’s ability to manage inflation and stabilize the economy has been a key factor in allowing the U.S. to carry high levels of debt without experiencing an economic crisis.

However, the Federal Reserve’s actions are not without risks. Persistently low interest rates, for instance, can create asset bubbles and distort financial markets. Moreover, the Fed’s decision to raise rates in response to inflationary pressures can increase borrowing costs, affecting both consumers and the government. Thus, the Fed’s role in managing the national debt requires careful balancing of inflation control, economic growth, and financial stability.

What This Means for Everyday Investors

For individual investors, understanding the relationship between the national debt and the broader economy is essential for making informed financial decisions. While the U.S. economy may not be on the brink of collapse, the growing national debt presents several risks and opportunities for investors:

- Opportunities in U.S. Treasury Bonds: As long as global demand for U.S. debt remains high, Treasury bonds will continue to be a safe investment. For risk-averse investors, government bonds remain an attractive option for steady, low-risk returns.

- Inflation Hedge: Investors concerned about inflationary pressures may look to real assets like gold, commodities, or real estate to hedge against potential declines in the value of the dollar.

- Stock Market Volatility: While the national debt itself may not trigger an economic crisis, changes in interest rates and inflation could impact stock market performance. Investors may need to adjust their portfolios based on shifting economic conditions.

Conclusion: A Complex Issue Without Simple Solutions

Dave Ramsey’s perspective on the national debt challenges the conventional narrative that it will inevitably lead to an economic collapse. While the rising debt presents real risks—especially in the long term—it is not an immediate threat to the U.S. economy. Ramsey’s view underscores the importance of understanding the underlying economic mechanisms that allow the U.S. to manage its debt effectively, including the unique position of the U.S. dollar and the role of global investors in sustaining demand for U.S. debt.

For investors, the key takeaway is that while the national debt is a serious issue, it does not necessarily spell doom for the economy in the short run. By staying informed and adjusting their strategies based on evolving economic conditions, investors can continue to navigate the complexities of the financial landscape without succumbing to unnecessary panic.

Ultimately, the national debt will remain a significant issue for policymakers to address, but for now, it is not the existential crisis that some would have us believe. As always, financial prudence and long-term planning are essential for navigating an uncertain future.

For more information on managing personal finance in times of economic uncertainty, visit Dave Ramsey’s official website.

For insights on U.S. economic policy and national debt, see this report from the Congressional Budget Office.

See more CNBC Network