Unpacking the Nasdaq’s Slide: Analyzing Government Moves and Zuckerberg’s Influence

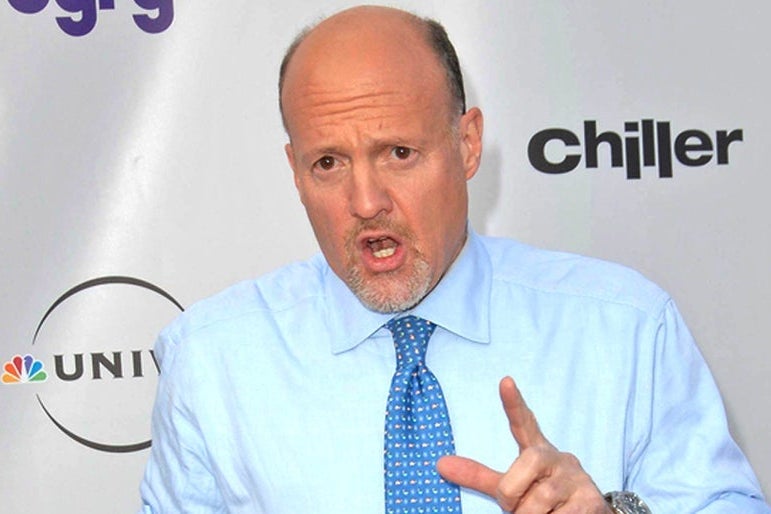

The Nasdaq Composite Index, a key barometer for technology stocks, has recently experienced a notable downturn. Financial commentator Jim Cramer has pointed to a dual cause for this decline: government actions and the strategic moves of tech giant Mark Zuckerberg. In this article, we will delve into how these two forces have intertwined to affect the Nasdaq, investor sentiment, and the broader tech market.

Understanding the Nasdaq’s Recent Decline

The Nasdaq’s decline isn’t just a random fluctuation; it’s a reflection of underlying economic realities and investor perception. The index is heavily weighted towards technology companies, meaning that any significant changes in that sector can have a pronounced impact on its performance. As of late 2023, a combination of regulatory scrutiny and corporate strategy shifts has contributed to a climate of uncertainty.

Government Actions: Regulation and Interest Rates

Government actions play a pivotal role in shaping market dynamics. In recent months, several key regulatory changes and monetary policy decisions have influenced investor confidence. Here are a few significant factors:

- Increased Scrutiny of Tech Firms: Regulatory bodies have ramped up their investigations into big tech companies, including Facebook, now under Meta Platforms, Inc., led by Mark Zuckerberg. This scrutiny focuses on data privacy, antitrust concerns, and misinformation. Such investigations can create a climate of uncertainty for investors.

- Interest Rate Hikes: The Federal Reserve’s decisions to raise interest rates in response to inflationary pressures have made borrowing more expensive and dampened consumer spending. Higher interest rates typically lead to lower valuations for growth stocks, which dominate the Nasdaq.

- Taxation Policies: Proposed changes in taxation, particularly targeting wealthy individuals and corporations, have raised concerns among investors about potential impacts on corporate profitability and economic growth.

These governmental moves have contributed to a broader narrative of risk and caution among investors, leading to a sell-off in tech stocks that significantly affects the Nasdaq.

Zuckerberg’s Influence: Strategic Shifts at Meta

Mark Zuckerberg’s leadership at Meta has also been a critical factor in the Nasdaq’s recent downturn. The company’s strategic pivots, particularly towards the metaverse, have raised eyebrows and elicited mixed reactions from investors.

- Metaverse Investments: Zuckerberg’s ambitious vision for the metaverse involves substantial investments that have yet to yield clear returns. This uncertainty has made investors wary, contributing to fluctuations in Meta’s stock price and, consequently, affecting the Nasdaq.

- Advertising Revenue Challenges: Meta has faced significant challenges in its core advertising business due to increased competition and regulatory pressures. This has led to downward revisions of earnings forecasts, further impacting investor sentiment.

- Public Perception and Trust Issues: Ongoing issues related to privacy concerns and misinformation have tarnished Meta’s reputation. Investor confidence is often tied to public perception, and any negative sentiment can lead to sell-offs.

As a result, Zuckerberg’s influence on Meta’s strategy has had ripple effects throughout the tech industry, contributing to the Nasdaq’s decline.

The Broader Implications for the Tech Market

The combination of governmental actions and Zuckerberg’s strategic decisions has broad implications for the tech market. Here are some key areas to consider:

Investor Sentiment and Market Volatility

The current climate has led to heightened volatility in tech stocks. Investors are increasingly cautious, weighing potential risks against the backdrop of regulatory scrutiny and corporate performance. This sentiment often leads to rapid sell-offs, further exacerbating market declines.

Valuation Adjustments

As interest rates rise, tech companies, particularly those reliant on future growth projections, may see their valuations recalibrate. Investors are likely to shift their focus towards companies with solid cash flows and stable earnings, leaving high-growth tech stocks vulnerable.

Innovation and Adaptation

Despite the challenges, the tech industry is known for its resilience and adaptability. Companies may be prompted to innovate more aggressively, finding ways to navigate regulatory hurdles and shifting consumer preferences. This could lead to new opportunities, albeit in a more cautious investment environment.

Looking Ahead: What’s Next for the Nasdaq?

As we unpack the Nasdaq’s slide, several potential scenarios emerge for the future:

- Regulatory Clarity: If governmental bodies provide clearer guidelines for tech companies, investor confidence may rebound, stabilizing the market.

- Corporate Restructuring: Companies like Meta may need to pivot their strategies to regain investor trust. This could involve re-evaluating their metaverse investments or enhancing their core advertising business.

- Market Recovery: Historical trends suggest that markets can recover from downturns, particularly if underlying fundamentals remain strong. A recovery in consumer spending and tech innovation could bolster the Nasdaq moving forward.

Conclusion: A Time for Caution and Opportunity

In summary, the Nasdaq’s slide can be traced back to a potent combination of government moves and the strategic maneuvers of figures like Mark Zuckerberg. While these factors have contributed to a challenging environment for tech investors, they also present opportunities for growth and adaptation. As the market evolves, investors will need to remain vigilant, seeking clarity amidst uncertainty and looking for potential opportunities in this dynamic landscape.

The interplay between regulation and corporate strategy will undoubtedly shape the future of the tech market, making it essential for investors to stay informed and agile in their decision-making.

See more CNBC Network