Key Market Trends to Watch: What Could Shape the Week Ahead?

As global markets prepare for another week of potential volatility, investors are closely monitoring three critical trends that could dictate financial performance. From central bank policy shifts to corporate earnings surprises and geopolitical tensions, these factors will likely influence stock, bond, and commodity markets worldwide. Analysts suggest that understanding these dynamics could help traders navigate uncertainty and capitalize on emerging opportunities.

1. Central Bank Decisions and Interest Rate Speculation

The Federal Reserve and European Central Bank (ECB) will dominate conversations this week as policymakers signal their next moves. With inflation showing mixed signals—core CPI easing to 3.6% in April while services remain sticky—the Fed faces mounting pressure to maintain higher rates longer. Futures markets now price in just one 25-basis-point cut for 2024, a stark reversal from January’s expectations of six reductions.

“The Fed’s ‘higher for longer’ stance has become the baseline scenario,” notes Lydia Boussour, senior economist at EY-Parthenon. “Markets are adjusting to the reality that premature easing could reignite inflationary pressures, especially with Q1 GDP growth holding at 1.6%.”

Key indicators to watch:

- Fed Chair Powell’s speech on Wednesday at the Washington Forum

- ECB’s updated inflation projections on Thursday

- Bank of Japan’s potential intervention as USD/JPY flirts with 160

2. Tech Earnings and AI Investment Surge

Second-quarter earnings season kicks into high gear with megacaps like NVIDIA, Microsoft, and Alphabet reporting. Analysts project 8.7% year-over-year earnings growth for S&P 500 companies, but the tech sector could outperform with 15.2% growth, according to FactSet data. NVIDIA’s results will be particularly scrutinized after its 90% year-to-date surge, with options markets implying an 11% post-earnings move.

Meanwhile, AI infrastructure spending shows no signs of slowing. Research firm IDC forecasts global AI-related investment will reach $301 billion in 2024, up 25% from 2023. “We’re seeing a ‘second wave’ of AI adoption,” says tech analyst Mark Lipacis. “Enterprises are moving beyond experimentation to full-scale implementation across cloud, healthcare, and manufacturing verticals.”

3. Geopolitical Risks and Commodity Price Swings

Oil markets remain on edge as Brent crude hovers near $83/barrel amid Middle East tensions and OPEC+ supply decisions. Gold’s record-breaking rally above $2,400/oz reflects both safe-haven demand and central bank accumulation, particularly from China. Agricultural commodities also warrant attention, with cocoa prices up 150% year-to-date due to West African supply disruptions.

Emerging market currencies face renewed pressure as the dollar index (DXY) tests 106. “The strong dollar is creating a divergence in global markets,” explains Standard Chartered’s Eric Robertsen. “While U.S. equities benefit from capital inflows, developing nations grapple with dollar-denominated debt burdens.”

Market Implications and Strategic Considerations

Investors should prepare for potential scenarios:

- Bull case: Tech earnings beat expectations, Fed signals September cut, and geopolitical tensions ease, sparking a 5% equity rally

- Base case: Mixed earnings, cautious central banks, and range-bound commodities lead to sideways trading

- Bear case: Inflation reacceleration, Middle East escalation, or China growth scare triggers risk-off sentiment

Sector rotation opportunities may emerge, with healthcare and utilities offering defensive positioning, while cyclical sectors like industrials could benefit from any dovish policy shifts. Fixed income investors might find value in short-duration Treasuries yielding over 5%, providing a cushion against equity volatility.

The Bottom Line: Navigating Uncertainty

This week’s market movements will likely hinge on the interplay between monetary policy signals, corporate fundamentals, and geopolitical developments. While volatility presents challenges, it also creates selective opportunities for disciplined investors. As always, maintaining diversified exposure and focusing on quality assets remains paramount in uncertain environments.

For real-time analysis on these market-moving trends, subscribe to our daily briefing and gain expert insights delivered to your inbox before the opening bell.

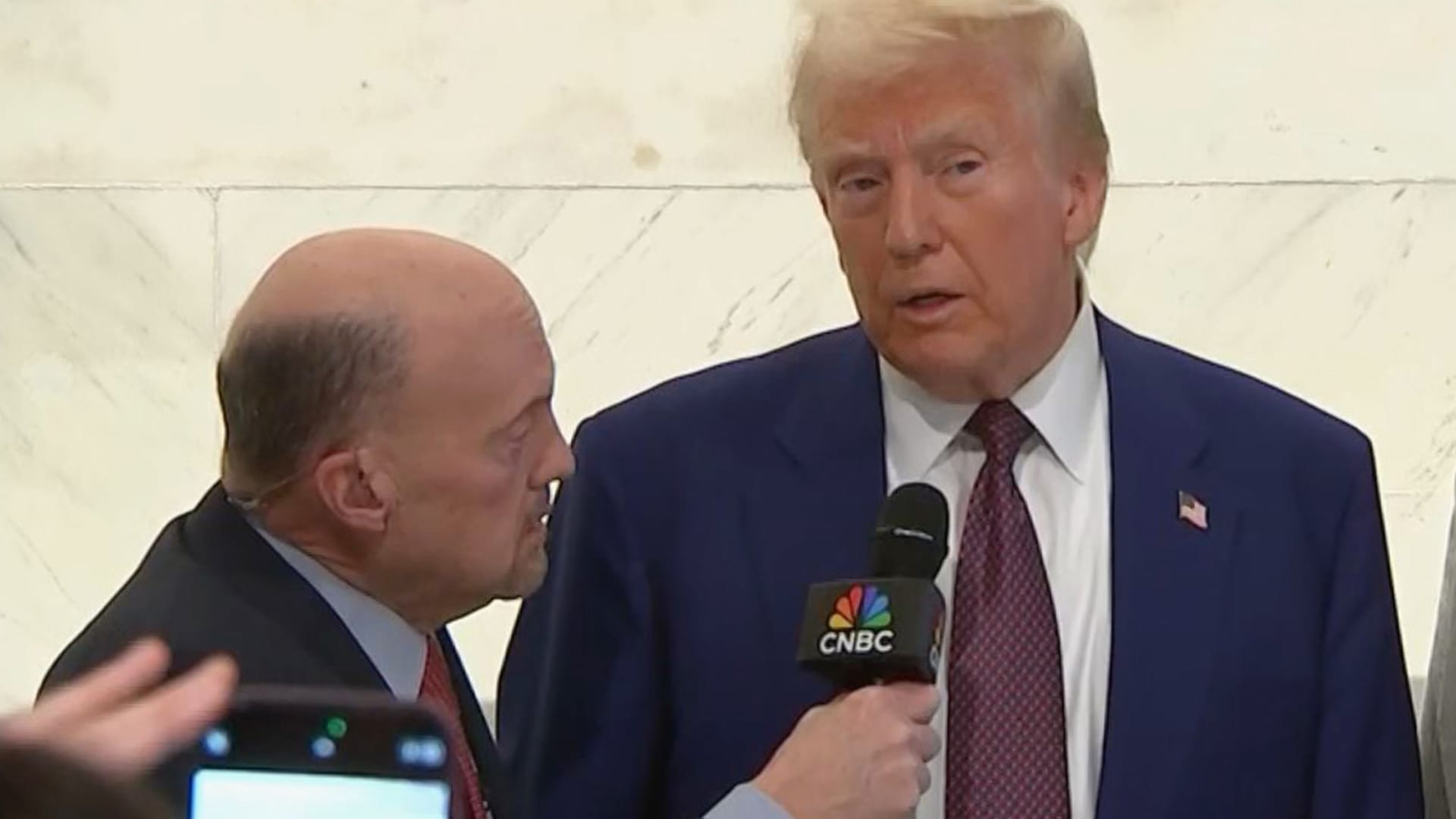

See more CNBC Network