JPMorgan Raises Red Flags: Is a Global Recession on the Horizon?

In a stark warning that sent ripples through financial markets, JPMorgan Chase & Co. has alerted investors to growing risks of a global recession. The banking giant’s analysts point to weakening economic indicators, geopolitical tensions, and tightening monetary policies as potential catalysts. As central banks worldwide grapple with inflation, experts warn the cumulative effect could trigger an economic downturn by late 2024 or early 2025.

Economic Storm Clouds Gather

JPMorgan’s research team identified several alarming trends in their latest global outlook report:

- Global manufacturing PMI has remained below the expansion threshold for 14 consecutive months

- Consumer confidence in major economies has dropped 18% year-over-year

- Yield curve inversions, a reliable recession predictor, persist in multiple developed markets

“The synchronization of these warning signs across economies is particularly concerning,” noted Dr. Evelyn Carter, JPMorgan’s Chief Global Economist. “When manufacturing slumps, services follow, and we’re seeing early signs of that domino effect in Europe and parts of Asia.”

The Inflation Dilemma

Central banks face their toughest challenge in decades as they attempt to balance inflation control with economic growth. The Federal Reserve, European Central Bank, and Bank of England have collectively raised interest rates 45 times since 2022. While inflation has moderated from peak levels, core prices remain stubbornly high.

“We’re in uncharted territory,” warned Mark Richardson, senior analyst at the Economic Policy Institute. “Previous recessions were caused by external shocks, but this time we might engineer one through monetary policy overcorrection.”

Recent data illustrates the precarious situation:

- U.S. GDP growth slowed to 1.4% in Q1 2024 from 3.2% a year prior

- Eurozone entered technical recession in Q4 2023 with two consecutive quarters of contraction

- China’s export growth turned negative for the first time since 2020

Diverging Views on Recession Risks

While JPMorgan’s warning carries significant weight, not all analysts share their pessimistic outlook. The International Monetary Fund recently upgraded its global growth forecast to 3.0% for 2024, citing resilient labor markets and strong consumer spending in North America.

The Bull Case: Soft Landing Scenario

Optimists point to several factors that could avert recession:

- U.S. unemployment remains at historic lows (3.8% as of May 2024)

- Corporate balance sheets show strong cash reserves

- Energy prices have stabilized after 2022 spikes

“The economy has shown remarkable adaptability,” argued financial strategist David Langley. “We’re seeing disinflation without mass layoffs—that’s the definition of a soft landing.”

Geopolitical Wild Cards

Beyond economic fundamentals, geopolitical tensions could tip the scales. Ongoing conflicts, trade restrictions, and supply chain realignments create unpredictable variables. The World Bank estimates that a major escalation in trade wars could shave 1.5 percentage points off global GDP.

Energy markets remain particularly vulnerable. “Another oil price shock would hit economies like a sledgehammer,” cautioned energy analyst Priya Desai. “Many nations have exhausted their fiscal buffers from the pandemic era.”

Sector-Specific Vulnerabilities

Certain industries face disproportionate risks in a potential downturn:

- Technology: After pandemic-era expansion, many firms face valuation pressures

- Real Estate: Commercial property values have declined 25% in major cities

- Automotive: High interest rates depress vehicle financing

However, defensive sectors like healthcare, utilities, and consumer staples typically weather recessions better. “Investors are already rotating into recession-resistant assets,” observed portfolio manager Michael Chen.

Preparing for Potential Economic Headwinds

Financial advisors recommend several precautionary measures:

- Diversify investments across asset classes and geographies

- Maintain emergency funds covering 6-12 months of expenses

- Reduce high-interest debt while credit remains available

- Review business continuity plans for operational resilience

“Hope for the best but prepare for the worst,” advised wealth manager Sarah Goldstein. “The businesses and households that survive recessions best are those who plan ahead.”

The Road Ahead

Key indicators to watch in coming months include:

- Central bank policy meetings (particularly Fed decisions on rate cuts)

- Q2 corporate earnings and forward guidance

- Consumer spending patterns during summer travel season

- Commodity price fluctuations, especially oil and food staples

While economists debate recession probabilities—currently estimated between 35-60% by various models—most agree vigilance is warranted. As JPMorgan’s report concludes: “The margin for error has never been thinner.”

For ongoing analysis of global economic trends, subscribe to our financial insights newsletter and receive expert commentary directly to your inbox.

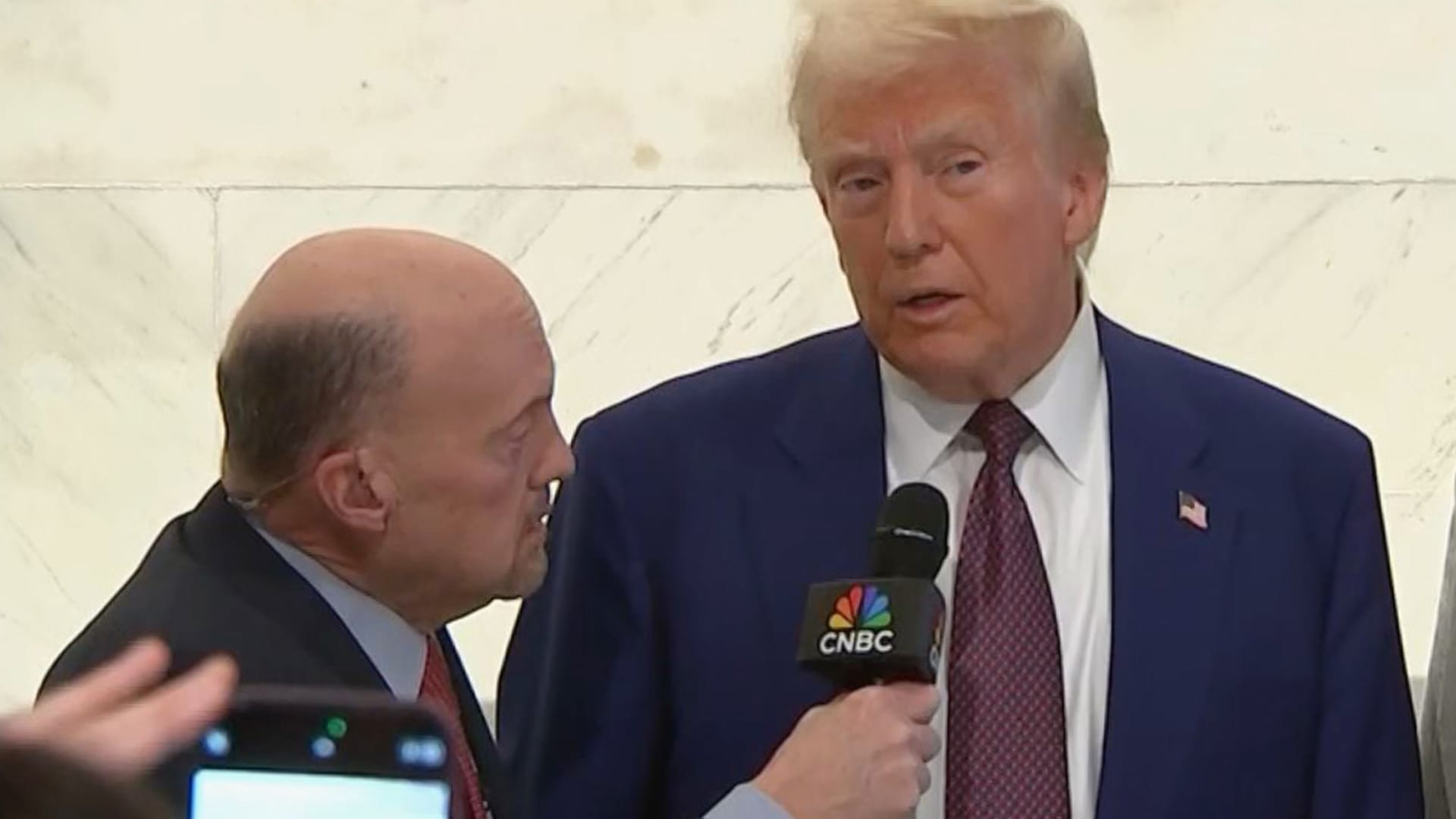

See more CNBC Network