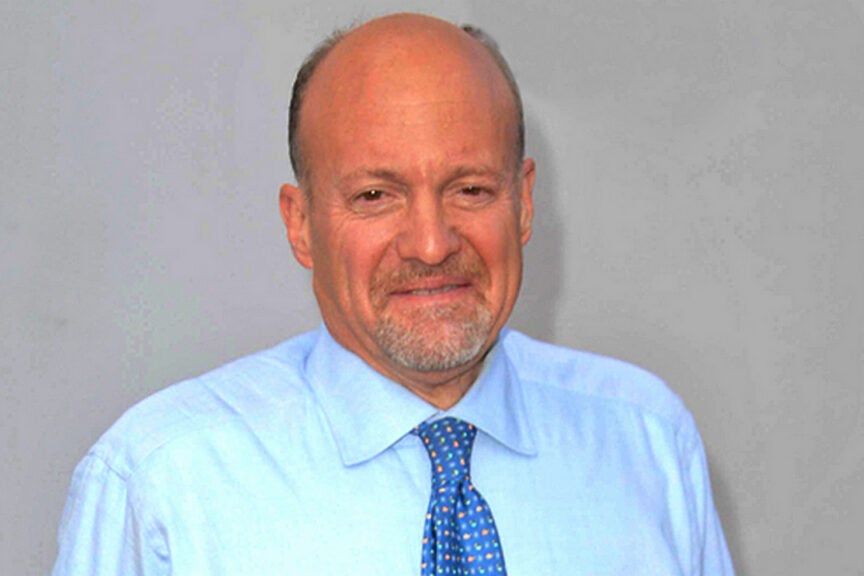

The stock market has long been a battleground for investors, with some viewing it as an opportunity for profit, while others approach it with caution, wary of the inherent risks. Recently, market volatility has sparked renewed conversations on how to navigate a market filled with significant surges in stock prices. Among the most vocal commentators on the matter is Jim Cramer, a prominent financial analyst and host of CNBC’s *Mad Money*. Cramer has voiced his concerns about the current market environment, particularly as stocks like Ulta Beauty, Lululemon, and DocuSign experience dramatic rallies. His cautious outlook urges investors to balance optimism with prudence, especially in the face of unpredictable economic conditions. In this article, we’ll delve deeper into Cramer’s commentary, the current market landscape, and strategies for navigating volatility.

Jim Cramer’s Cautious Stance on Market Volatility

Jim Cramer has made a name for himself by providing bold stock recommendations, often with a mix of enthusiasm and caution. However, in recent weeks, his tone has shifted to a more conservative outlook, as he reflects on the ongoing market volatility. Stocks like Ulta Beauty, Lululemon, and DocuSign, which have shown impressive rallies, have prompted Cramer to warn investors against being too hasty with their bullish outlooks. Cramer’s key message is clear: while these rallies may seem promising, they could be unsustainable in the long run.

The Danger of Overzealous Optimism

Cramer’s concerns are rooted in the uncertainty that characterizes today’s economic environment. A combination of global supply chain disruptions, inflationary pressures, and geopolitical tensions has created a volatile backdrop for the stock market. As a result, investors are faced with a complex decision: should they seize the opportunity to ride the wave of surging stocks, or adopt a more cautious approach in anticipation of a potential pullback?

Stocks like Ulta Beauty, Lululemon, and DocuSign have become emblematic of this trend. These companies have seen remarkable increases in their stock prices, driven by strong earnings reports, positive growth projections, and a rebound in consumer demand. However, Cramer argues that investors must be wary of buying into these rallies without fully understanding the risks involved.

- Ulta Beauty – The beauty retailer has benefited from a resurgence in consumer spending, particularly in the beauty and personal care sectors. While its performance has been impressive, Cramer cautions that its stock price may be inflated in anticipation of continued growth that could prove difficult to sustain.

- Lululemon – Lululemon has long been a favorite among growth investors, but recent rallies in its stock price may have created a bubble. Cramer emphasizes that the company’s high valuation could make it more vulnerable to market corrections if consumer spending slows or if competitors offer similar products at lower prices.

- DocuSign – DocuSign’s surge has been fueled by the growing demand for digital signature solutions, accelerated by the pandemic. However, as the world returns to more traditional business operations, the sustainability of DocuSign’s growth remains uncertain. Cramer warns that investors should not assume that the pandemic-era boom will continue indefinitely.

For investors, Cramer’s advice is clear: optimism must be tempered with caution. The market is unpredictable, and just because stocks are rising does not guarantee they will continue on their upward trajectory.

Understanding Market Volatility and its Impact on Investment Strategies

Market volatility refers to the degree of variation in the price of stocks, bonds, and other financial assets over time. It can be influenced by a range of factors, from economic reports and corporate earnings to geopolitical events and natural disasters. While volatility can present opportunities for short-term gains, it also increases the level of risk for investors, particularly those who are not prepared for sudden market corrections.

Volatility in the Context of Global Economic Uncertainty

In the current economic climate, volatility is being exacerbated by multiple global factors. The aftermath of the COVID-19 pandemic has led to disruptions in supply chains, labor shortages, and inflationary pressures. Central banks, including the U.S. Federal Reserve, have responded with interest rate hikes to combat rising prices, further affecting stock market dynamics. In addition, ongoing geopolitical instability, particularly in Eastern Europe and Asia, has added another layer of uncertainty to the market.

For investors, this environment poses a significant challenge. On one hand, there are stocks that appear to be poised for growth, such as those in the tech sector and consumer goods. On the other hand, macroeconomic factors could trigger a market correction, leading to a sharp decline in stock prices.

As Cramer highlights, the key to navigating this uncertainty lies in balancing risk and reward. Investors should avoid chasing speculative stocks based solely on their recent performance and instead focus on companies with solid fundamentals and a proven track record of growth. Additionally, diversifying one’s portfolio can help mitigate risk by spreading investments across various asset classes, sectors, and geographic regions.

The Role of Risk Management in Volatile Markets

Effective risk management is a critical component of any investment strategy, particularly in volatile market conditions. One approach to managing risk is through asset allocation, which involves spreading investments across different types of assets, such as stocks, bonds, and real estate. This helps to reduce the impact of a downturn in any single asset class.

Another important tool for managing risk is the use of stop-loss orders. These are automatic sell orders placed on stocks at a predetermined price, allowing investors to limit potential losses if a stock price falls below a certain threshold. While this strategy is not foolproof, it can help protect against sudden downturns.

Market Cycles and the Importance of Patience

The stock market operates in cycles, with periods of growth followed by periods of contraction. While the bull markets of the past few years have driven stocks to new heights, it is important to remember that these rallies are often followed by periods of consolidation or decline. Cramer frequently emphasizes the importance of patience in investing, particularly in volatile environments. Rather than attempting to time the market or chase short-term gains, investors should focus on long-term objectives and allow their investments to grow gradually over time.

Furthermore, investors should be aware of the psychological pitfalls that can accompany market volatility. It is easy to become overly optimistic when stocks are soaring and equally easy to become overly pessimistic when the market experiences a dip. Successful investors are those who can maintain a level-headed approach, making decisions based on data and analysis rather than emotions.

The Broader Implications of Market Volatility

The effects of market volatility extend beyond individual investors. For companies, large fluctuations in stock prices can influence their ability to raise capital and make long-term investment decisions. Additionally, when market sentiment shifts dramatically, consumer confidence can be affected, leading to changes in spending patterns and broader economic outcomes.

For policymakers, managing market volatility is a delicate balancing act. While central banks can attempt to influence the market through interest rate adjustments and other monetary policies, they must also be mindful of the potential for unintended consequences. Aggressive rate hikes, for example, could slow economic growth or lead to a recession, while keeping rates too low for too long could fuel further inflationary pressures.

In this environment, investors, companies, and policymakers alike must exercise caution and foresight to navigate the challenges of market volatility.

Jim Cramer’s reflections on market volatility serve as a timely reminder of the need for caution in an era of uncertainty. While the stock market has experienced significant rallies in some sectors, such as Ulta Beauty, Lululemon, and DocuSign, it is crucial for investors to maintain a balanced approach, taking into account both the potential rewards and the risks involved. By focusing on solid fundamentals, diversifying portfolios, and practicing effective risk management, investors can better navigate the turbulence of today’s market. Ultimately, patience and a long-term perspective will be key to weathering market fluctuations and achieving sustainable investment success.

For more insights on navigating market volatility, visit CNBC’s financial analysis page.

See more CNBC Network