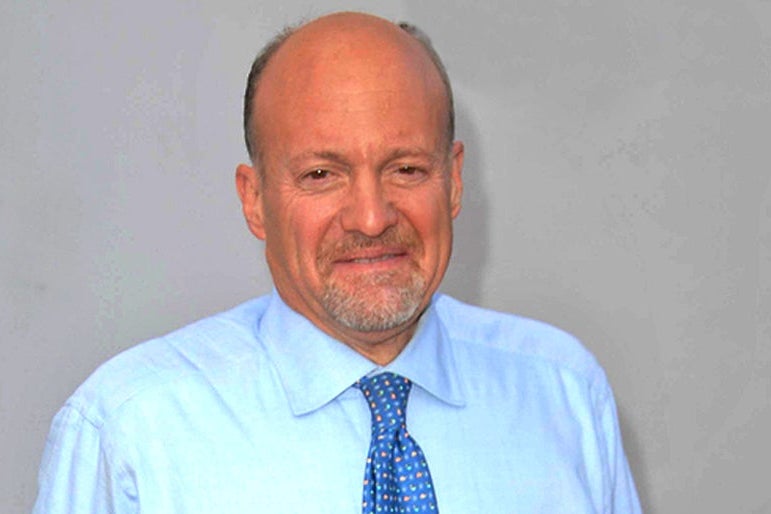

Jim Cramer, the renowned financial expert and host of CNBC’s *Mad Money*, has been an outspoken advocate for cryptocurrencies, particularly Bitcoin and Ethereum. His latest commentary highlights the growing importance of these digital assets in investment portfolios, urging investors to consider them as a hedge against the increasing U.S. debt. As the national debt continues to climb, Cramer’s call for crypto as a strategic safeguard is resonating with both traditional investors and crypto enthusiasts alike. But what makes Cramer’s endorsement so significant, and what does it mean for the broader financial landscape?

Jim Cramer’s Longstanding Interest in Cryptocurrency

For years, Jim Cramer has publicly discussed his views on cryptocurrencies, especially Bitcoin and Ethereum, which he believes could play a vital role in the future of finance. While his opinions have fluctuated, Cramer’s latest stance appears to lean heavily towards the idea of digital assets as part of a diversified investment strategy.

Cramer’s advocacy comes at a time when both Bitcoin and Ethereum have reached new levels of maturity in the market, and institutional adoption is on the rise. As more traditional financial players move into the crypto space, Cramer’s comments reflect a broader shift in perception. Cryptocurrency, once dismissed as a speculative asset, is increasingly being seen as a legitimate store of value.

The Role of Bitcoin and Ethereum in Investment Strategies

Bitcoin and Ethereum, the two most prominent cryptocurrencies, offer distinct advantages that make them appealing to investors. Bitcoin, often referred to as “digital gold,” is widely regarded as a hedge against inflation and a store of value. Ethereum, on the other hand, is not just a cryptocurrency but a platform for decentralized applications (dApps) and smart contracts, which adds an additional layer of utility beyond being a mere store of value.

Bitcoin: A Hedge Against Inflation and Debt

Bitcoin’s value proposition largely stems from its fixed supply of 21 million coins, which contrasts sharply with the ever-increasing supply of fiat currencies. As the U.S. national debt grows, the risk of inflation increases, diminishing the purchasing power of the dollar. In this environment, Bitcoin offers a potential safeguard, as its scarcity is seen as a counterbalance to the inflationary effects of central bank monetary policies.

Cramer has highlighted Bitcoin’s ability to act as a store of value, particularly during times of economic uncertainty. With the U.S. national debt surpassing $33 trillion, the prospect of future inflation looms large. Bitcoin’s decentralized nature and fixed supply could make it an appealing option for those looking to protect their wealth from the eroding effects of inflation.

Ethereum: Beyond Digital Currency

Ethereum’s unique position in the crypto world stems from its role as both a digital currency and a platform for decentralized applications. The Ethereum network powers the majority of decentralized finance (DeFi) protocols, non-fungible tokens (NFTs), and blockchain-based applications. Its native token, Ether (ETH), is used not only as a medium of exchange but also as “gas” to power transactions and smart contracts on the network.

In terms of investment, Ethereum presents an opportunity for diversification. While it shares some characteristics with Bitcoin, such as being a store of value, it also offers additional avenues for growth. Investors in Ethereum may benefit from its potential in sectors such as DeFi, gaming, and NFTs, which are gaining traction within the broader digital economy.

The U.S. Debt Crisis and its Impact on Financial Markets

The United States has been grappling with a mounting national debt for years, and the recent fiscal policies aimed at mitigating the economic effects of the COVID-19 pandemic have only added to the strain. The Federal Reserve has maintained a low-interest-rate environment for much of the past decade, which has fueled debt accumulation, while also contributing to a series of economic bubbles, including the housing market crisis and, more recently, the tech stock boom.

As the debt continues to grow, the U.S. government faces pressure to either raise taxes or cut spending, both of which carry significant political and economic risks. The uncertainty surrounding fiscal policy has created an environment in which traditional assets, like stocks and bonds, may be viewed as increasingly vulnerable to inflation and currency devaluation. This is where cryptocurrencies like Bitcoin and Ethereum enter the picture, as they provide an alternative that is not directly tied to the performance of traditional financial systems.

The Role of Crypto in a Diversified Portfolio

Adding cryptocurrencies like Bitcoin and Ethereum to an investment portfolio can provide several potential benefits:

- Inflation Hedge: Both Bitcoin and Ethereum are often seen as hedges against inflation, as their supply is limited or governed by predictable algorithms, unlike fiat currencies which can be printed at will.

- Decentralization: The decentralized nature of cryptocurrencies means that they are not subject to the same risks as traditional financial systems, such as government intervention or central bank policies.

- Potential for High Returns: Cryptocurrencies, while volatile, have historically shown the potential for significant returns over time. For risk-tolerant investors, this can be an attractive proposition.

- Global Accessibility: Cryptocurrencies can be accessed and traded by anyone with an internet connection, which offers diversification opportunities for investors globally.

However, it is important to note that cryptocurrencies remain highly volatile and speculative. Investors should approach them with caution, balancing their portfolios to include a mix of traditional and digital assets.