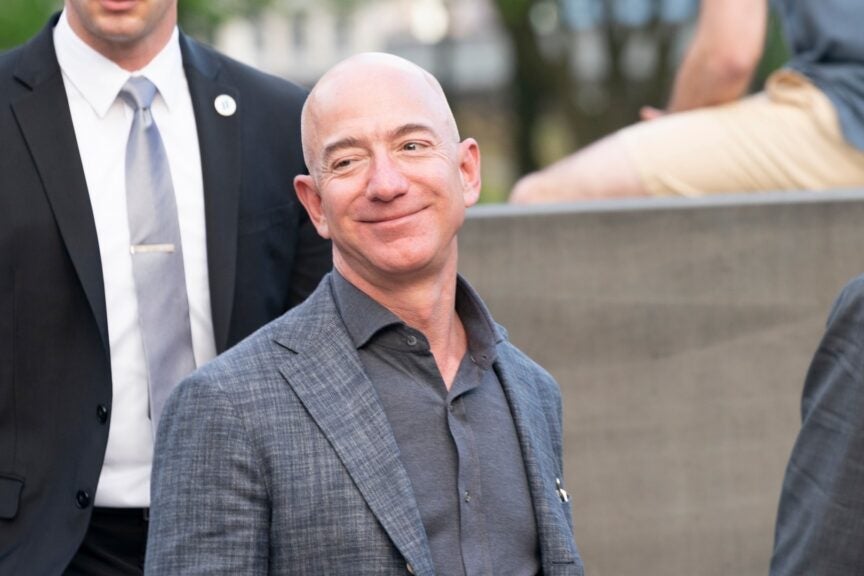

How Jeff Bezos’s Wealth Once Surpassed the Total Value of Bitcoin: A Turning Point in Financial History

In 2020, the financial world witnessed a momentous event: Amazon founder Jeff Bezos’s personal wealth briefly eclipsed the total market capitalization of Bitcoin, the world’s first and most valuable cryptocurrency. This historic event raised eyebrows and served as a marker of changing dynamics in both traditional and digital wealth. At that time, the convergence of Bezos’s immense fortune and Bitcoin’s volatile price growth highlighted a significant turning point in the relationship between established wealth and digital assets. It also underscored the growing influence of cryptocurrency in the broader financial ecosystem, forever altering the way we think about wealth accumulation in the 21st century.

The Context: A Rising Tech Mogul vs. A Revolutionary Digital Asset

To understand the significance of Bezos surpassing Bitcoin’s total value, it’s essential to place this event in the broader context of wealth accumulation and the rise of digital currencies. Jeff Bezos, through his creation of Amazon, had amassed one of the largest fortunes in modern history. By 2020, his wealth was estimated to be more than $190 billion, driven primarily by Amazon’s stock price surge during the global pandemic. This made him the richest man in the world at the time, surpassing other billionaires like Bill Gates, Elon Musk, and Warren Buffet.

Bitcoin, on the other hand, had been experiencing a meteoric rise in value since its creation in 2009 by the pseudonymous Satoshi Nakamoto. At the start of 2020, the total value of all Bitcoin in circulation was just over $150 billion. By the middle of the year, as more investors flocked to the asset due to its perceived potential as a store of value, Bitcoin’s total market capitalization surpassed the $200 billion mark, but Bezos’s fortune briefly outstripped it. This moment marked the first time a single individual’s net worth was larger than the combined value of the entire cryptocurrency market.

The Rise of Bezos’s Wealth

Bezos’s personal wealth was a direct reflection of the rapid growth of Amazon, which in turn was driven by a global shift toward e-commerce, particularly in light of the COVID-19 pandemic. As lockdowns and social distancing measures were implemented worldwide, consumers increasingly turned to online shopping. Amazon, being the largest e-commerce platform, benefited immensely from this surge in demand.

- Amazon’s stock price more than doubled between March 2020 and December 2020, reflecting an increasing reliance on digital shopping.

- The expansion of Amazon Web Services (AWS), Amazon’s cloud computing arm, also contributed significantly to Bezos’s net worth, further diversifying the sources of Amazon’s value.

- Bezos’s strategic decision to focus on long-term growth over short-term profit maximization allowed Amazon to weather economic storms and continue its upward trajectory.

However, while Bezos’s wealth was built on a highly diversified and successful business model, Bitcoin’s rise was driven by speculation, innovation, and the belief in decentralized financial systems. The fact that Bezos’s personal wealth briefly surpassed the entire value of Bitcoin highlighted two key trends in the financial world: the immense wealth of Silicon Valley tech moguls and the increasing mainstream attention that digital assets were starting to command.

Bitcoin’s Volatility and the Shift in Financial Power

Bitcoin is renowned for its price volatility, which was on full display throughout 2020 and 2021. While its price surged to new heights, it also experienced significant downturns. This volatility made it a speculative asset, appealing to a select group of investors and institutions that saw it as a hedge against inflation or a store of value akin to digital gold. However, Bitcoin’s total market capitalization could fluctuate dramatically due to factors such as:

- Massive fluctuations in price driven by market sentiment, regulatory news, and institutional adoption.

- Increased competition from other cryptocurrencies, including Ethereum, which also attracted substantial investment.

- Government and central bank interventions that influenced the macroeconomic environment, thereby affecting investor behavior toward Bitcoin.

In contrast, Bezos’s wealth was tied to a tangible and highly profitable business model. While both Bitcoin and Bezos’s fortune represented new forms of wealth accumulation, their sources were fundamentally different. Bezos’s wealth was the result of years of strategic business decisions and operational expansion, whereas Bitcoin’s value was driven more by speculative interest, public perception, and the development of decentralized financial technologies.

The Broader Implications: The Intersection of Traditional Wealth and Digital Assets

The convergence of Bezos’s wealth with Bitcoin’s total market capitalization raised critical questions about the future of wealth creation. At a fundamental level, this moment highlighted a shift in how wealth is being defined in the modern era. Traditionally, wealth was linked to tangible assets, industrial production, and ownership of large-scale businesses. Today, however, new forms of wealth are emerging based on intangible assets, digital platforms, and cryptocurrencies.

The idea that a tech entrepreneur like Bezos could be compared to a decentralized digital asset like Bitcoin challenged long-held assumptions about how wealth is accumulated and distributed in society. As cryptocurrencies continue to grow in popularity, traditional wealth models are facing increasing pressure to adapt.

The Role of Cryptocurrencies in Shaping the Future of Finance

While the initial rise of Bitcoin and other cryptocurrencies was largely seen as speculative, there is now a growing recognition of their potential to reshape the financial landscape. Digital assets such as Bitcoin, Ethereum, and other blockchain-based technologies are gradually being accepted as legitimate stores of value and methods of transacting wealth. Several factors contribute to this shift:

- Institutional Adoption: Over the past few years, institutional investors and major corporations have started to invest in cryptocurrencies, legitimizing them as viable financial assets. Companies like Tesla, Square, and MicroStrategy have made significant Bitcoin purchases, signaling confidence in the future of digital assets.

- Regulatory Clarity: As governments around the world develop clearer frameworks for cryptocurrency regulation, digital assets are becoming more integrated into the global financial system. This regulatory clarity helps reduce the risks associated with investing in cryptocurrencies.

- Financial Inclusion: Cryptocurrencies provide a means of accessing financial services for individuals in countries with underdeveloped banking systems, further expanding the role of digital assets in global finance.

The growing intersection between traditional wealth and digital currencies is not only reshaping how wealth is created but also influencing how we think about the future of money. With central bank digital currencies (CBDCs) and other blockchain innovations gaining momentum, we may be witnessing the early stages of a paradigm shift in the global financial system.

What’s Next? The Evolving Nature of Wealth

As we move further into the 21st century, the debate between traditional wealth and cryptocurrency is bound to intensify. Will the wealth accumulated by tech moguls like Bezos continue to dominate, or will digital assets like Bitcoin take on a larger role in shaping financial power? The answer likely lies in the continued evolution of both sectors. Traditional wealth holders may increasingly adopt digital assets as part of their investment portfolios, while cryptocurrencies will continue to mature and integrate into mainstream finance.

The brief period when Jeff Bezos’s wealth surpassed Bitcoin’s total value serves as a reminder of the dynamic and shifting nature of wealth in the modern world. Whether through traditional business ventures or groundbreaking new technologies, the world of finance is changing faster than ever before, and the lines between the old guard and the new digital frontier are becoming increasingly blurred.

As we look ahead, the fusion of traditional wealth with digital innovation will likely set the stage for the next chapter in global finance, one where cryptocurrencies, blockchain technologies, and tech-driven business models will coexist and evolve side by side.

Conclusion

The moment when Jeff Bezos’s fortune briefly surpassed Bitcoin’s total value was more than just a headline— it was a pivotal event that encapsulated the intersection of traditional wealth and emerging digital assets. This moment marks a broader turning point in the history of finance, where decentralized technologies are no longer viewed as fringe innovations but as integral components of the financial system. As the financial world continues to evolve, both traditional wealth and digital assets will play an increasingly intertwined role in shaping the global economy.

For more information on the evolving landscape of digital currencies and their impact on the financial system, check out this comprehensive guide to cryptocurrency investing.

Additionally, stay up-to-date with the latest trends in wealth creation by visiting Financial Times.

See more CNBC Network