As the financial markets prepare for a significant event on November 29, traders, investors, and market analysts are focusing their attention on the scheduled FX option expiries at 10:00 AM New York time. This pivotal moment in the currency market could have widespread effects, not just for the immediate term, but also for the coming weeks. Understanding the dynamics of FX option expiries and their potential impact on currency movements is critical for anyone involved in the foreign exchange markets. This article explores the significance of these expiries, the forces at play, and how they could shape the broader market environment.

Understanding FX Option Expiries

Foreign exchange (FX) options are financial derivatives that give traders the right, but not the obligation, to buy or sell a currency pair at a predetermined price, known as the strike price, before or on a specified expiry date. These options are a critical tool for hedging currency risk, speculating on price movements, and managing volatility in the global FX market. The expiration of these options can lead to significant price movements in the underlying currency pairs, as traders unwind positions or adjust their strategies based on the expiration outcomes.

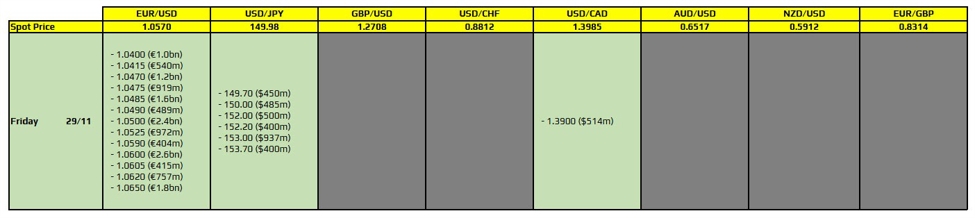

FX options expire at set times, with the most common being 10:00 AM New York time (3:00 PM GMT) on the third Wednesday of every month. However, in some cases, expirations can also be scheduled for the end of the trading day. On November 29, market participants will be closely monitoring the specific levels of open interest, the range of strikes for these options, and the prevailing market conditions that could lead to sharp movements in major currency pairs like the EUR/USD, GBP/USD, and USD/JPY.

What Happens When FX Options Expire?

When FX options near their expiry, the price of the underlying currency pair can experience heightened volatility. This is particularly true when the price of the currency pair is near the strike prices of a large volume of outstanding options. The following dynamics typically occur:

- Pinning to Strike Prices: One of the most common occurrences around FX option expiry is the phenomenon known as “pinning.” If a currency pair’s price is close to a significant strike price, market participants may see little price movement as the market gravitates toward the strike level. This could occur because traders with positions in these options will try to manage them in a way that minimizes their potential losses or maximizes profits at the expiry moment.

- Unwinding of Positions: As the expiration approaches, traders holding large positions in options may unwind their trades, which can create an influx of buy or sell orders that further impact the market. These unwinds are particularly impactful if they occur in high-liquidity currency pairs.

- Delta Hedging: Another important aspect is delta hedging, where traders or institutions that have written the options adjust their portfolios to neutralize their exposure to the movements in the underlying asset. This often results in additional buying or selling activity as the expiration time draws near, exacerbating volatility.

November 29 FX Option Expiry: What to Expect?

The expiration of FX options on November 29 at 10:00 AM New York time is likely to create considerable market tension, given the current geopolitical, economic, and market conditions. Here are some key factors to consider in the lead-up to this event:

Market Volatility

Global markets have experienced significant fluctuations recently due to factors like the ongoing effects of inflation, central bank policy decisions, and geopolitical tensions, particularly in Europe and Asia. Currency markets are inherently volatile, and the expiration of FX options often exacerbates this volatility. Traders may anticipate price swings as the expiry time nears, especially in major currency pairs such as the EUR/USD, GBP/USD, and USD/JPY.

Implied Volatility and Strikes

Implied volatility is another key element to watch. Higher implied volatility indicates a greater expected price fluctuation, which can affect option premiums and the way traders approach the expiration. In the case of November 29, implied volatility for major currency pairs could be influenced by central bank commentary or any surprise economic data releases leading up to the expiry. These market expectations will dictate the range of strikes where most of the open interest lies and where traders might focus their attention.

Central Bank Influence

Recent statements from the Federal Reserve and the European Central Bank, coupled with macroeconomic data, could lead to heightened market sensitivity. A shift in policy stance, or unexpected announcements relating to interest rates or inflation targets, may push currency prices toward certain strike prices, triggering large movements in the market during the expiry window.

FX Option Expiries and Currency Market Strategies

For traders, understanding the potential impact of FX option expiries is essential for effective strategy formulation. Here are a few common approaches that market participants may adopt ahead of the November 29 expiration:

- Option Writing and Hedging: Traders who have sold options (written options) may look to hedge their exposure by taking positions in the underlying currency pair. If the options are close to expiry and near a key strike price, these traders will likely engage in buying or selling the underlying currency to limit risk and ensure a neutral portfolio.

- Straddle or Strangle Strategies: Some traders may place a “straddle” or “strangle” around the expected strike price, betting on large moves in either direction. This strategy is particularly popular when volatility is expected to rise, as options can be positioned to capture a price move, regardless of direction.

- Pre-expiry Positioning: Traders often adjust their positions in anticipation of market moves, either by closing out existing trades or by opening new positions based on their expectations of volatility. This could involve moving stop-loss levels, taking profits, or entering new speculative trades.

The Broader Implications of FX Option Expiries

FX option expiries are not isolated events; they can have significant implications for broader financial markets. The effect of large-scale expiry movements can spill over into other asset classes such as equities, commodities, and fixed income markets. For example, a sharp move in the EUR/USD currency pair might influence European stock markets, particularly those of multinational companies that have significant foreign exchange exposure.

Moreover, the impact of these expiries can have cascading effects on risk sentiment in the market. If a particular currency strengthens unexpectedly due to the expiration, investors may adjust their equity portfolios, shifting capital flows away from risk assets or emerging markets into safe-haven currencies like the U.S. dollar or Swiss franc.

Conclusion

As the FX option expiries on November 29 loom, market participants must carefully consider the potential for heightened volatility and the strategic moves that could follow. With a range of factors – from implied volatility and geopolitical risks to central bank actions – influencing the dynamics of the currency markets, this expiry window presents both opportunities and risks for traders and investors alike.

By understanding the underlying forces at play, as well as the likely movements around key strike prices, market participants can better navigate the complexities of FX options and adjust their strategies accordingly. As always, caution and preparedness will be essential as this critical moment in the FX landscape unfolds.

For more information on how FX options work and their role in global financial markets, visit Investopedia.

To stay updated on market movements and expert analyses, be sure to follow reliable financial news sources like Bloomberg.

See more CNBC Network