Five Witty Cartoons That Illuminate the Perils of Broken Nest Eggs

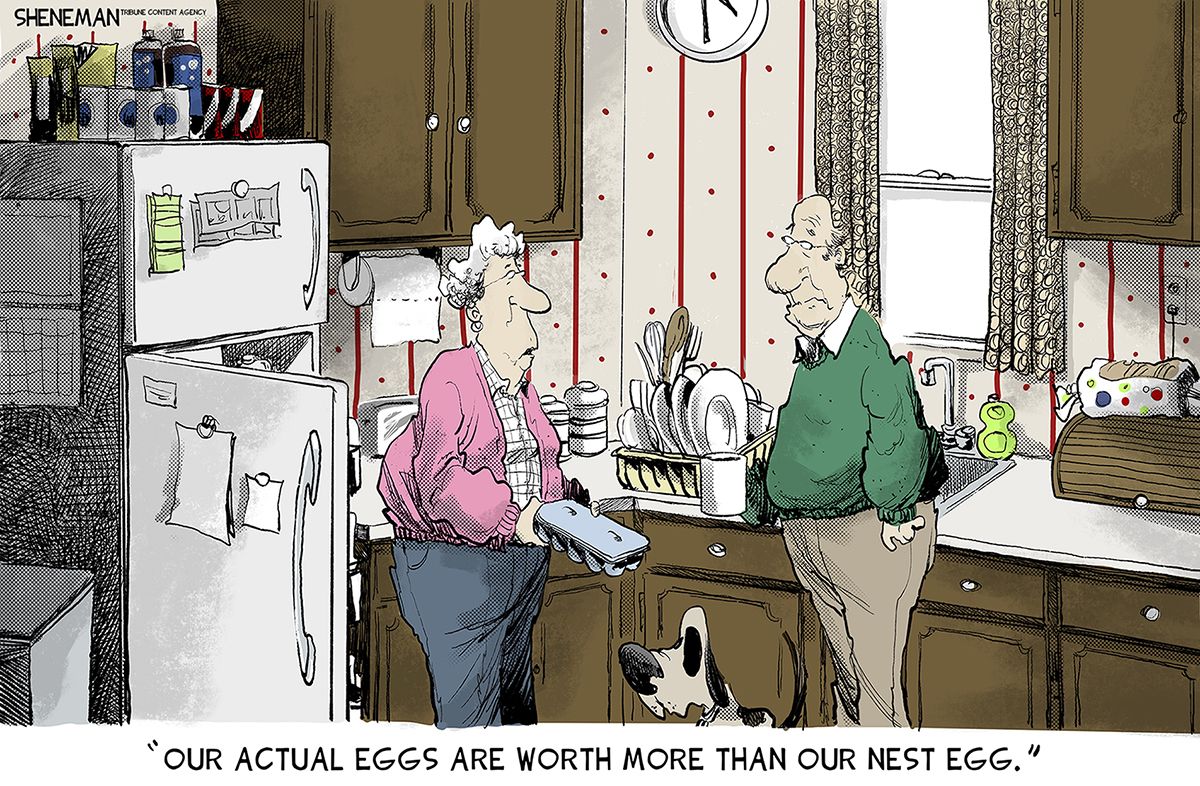

Financial insecurity is no laughing matter—until a sharp-witted cartoonist gets hold of it. A new wave of illustrations is using humor to highlight the precarious state of retirement savings, offering both comic relief and sobering truths. These five cartoons, created by acclaimed artists, expose the pitfalls of poor financial planning while underscoring the urgency of safeguarding nest eggs. Here’s how satire is making fiscal responsibility more relatable.

The Power of Visual Storytelling in Financial Literacy

Cartoons have long served as mirrors to society, and financial struggles are no exception. A 2022 study by the National Endowment for Financial Education found that 68% of Americans struggle with basic financial concepts, making visual aids critical for engagement. “Humor disarms people,” says Dr. Laura Simmons, a behavioral economist at Yale University. “When we laugh at a cartoon about depleted 401(k)s, we’re also internalizing its message.”

One standout illustration depicts a retiree fishing in a barren pond labeled “Savings Account,” with a sign reading “Gone Fishing—Permanently.” The image resonates with data from the Federal Reserve, which reports that 25% of non-retired adults have zero retirement savings. Such cartoons bridge the gap between dry statistics and emotional impact.

Breaking Down the Top Five Cartoons

Here’s a closer look at the artworks sparking conversations:

- “The House of Cards Retirement Plan”: A couple lounges on a pyramid of credit cards, oblivious to the looming collapse. The cartoon echoes a 2023 TransUnion report showing that consumer debt rose by $1.4 trillion in five years.

- “Social In-Security”: A cracked egg labeled “Social Security” oozes yolk into a thimble. This darkly funny take aligns with projections that Social Security reserves may deplete by 2035.

- “The Bitcoin Rollercoaster”: A wide-eyed investor clutches a plunging cryptocurrency graph, his nest egg scattered like confetti. Volatility warnings have never been this vivid.

Expert Reactions: Why Satire Works

Financial advisors praise these cartoons for sparking dialogue. “People tune out spreadsheets but remember a clever visual,” says Mark Reynolds, a certified financial planner. He cites a client who, after seeing a cartoon about impulsive spending, finally committed to a budget.

However, some critics argue that humor trivializes serious issues. “Not everyone can laugh when they’re facing real financial ruin,” cautions sociologist Dr. Elena Torres. Yet even she acknowledges that satire can motivate action where fear often paralyzes.

The Bigger Picture: A Call to Action

Beyond laughs, these cartoons underscore systemic problems. The U.S. faces a $7 trillion retirement savings shortfall, per the Economic Policy Institute. While policymakers debate fixes, individuals can take steps:

- Automate savings to curb impulsive spending

- Diversify investments beyond volatile assets

- Seek fiduciary advisors to navigate complex plans

As retirement grows more uncertain, these cartoons serve as both warning and wake-up call. Their blend of wit and wisdom might just be the nudge needed to secure fragile nest eggs—before they crack for good.

Ready to fortify your financial future? Start by reviewing your retirement plan with a trusted advisor today.

See more CNBC Network