As we approach the tax season of 2025, a pivotal year for taxpayers, understanding the tax changes that lie ahead is paramount. With the tax landscape continuously evolving, being informed and prepared can save you from unforeseen complications and potential financial pitfalls. This article delves into the essential insights regarding the upcoming tax changes and offers tips to help taxpayers navigate the complexities effectively.

Understanding the Tax Landscape for 2025

The tax code is not static; it undergoes revisions that can significantly impact individual and business taxpayers. For 2025, several key changes are on the horizon that every taxpayer should be aware of:

- Increased Standard Deductions: One of the most notable changes is the adjustment of the standard deduction, which is expected to rise. This change could benefit many taxpayers, allowing them to reduce their taxable income more significantly.

- New Tax Brackets: With inflation adjustments, the IRS will likely introduce new tax brackets. Understanding these changes will help you plan your income and expenditures wisely.

- Changes in Capital Gains Tax: Proposed revisions to capital gains tax rates could affect investors. Keeping an eye on these developments is crucial for future investment strategies.

- Retirement Account Contribution Limits: Increases in contribution limits for retirement accounts, such as 401(k)s and IRAs, are anticipated, allowing individuals to save more for their retirement while enjoying tax advantages.

Essential Tips for Preparing for Tax Changes

With these changes looming, preparation is key. Here are some essential tips to ensure you’re ready for the tax season of 2025:

- Stay Informed: Regularly check IRS announcements and other credible sources for updates on tax laws. Changes can occur rapidly, and being proactive will keep you ahead.

- Review Your Financial Situation: Conduct a comprehensive review of your finances. Assess your income, deductions, and credits to determine how the upcoming changes will affect you.

- Consult with a Tax Professional: Engaging a tax professional can provide personalized insights tailored to your financial situation. They can help you navigate complex changes and identify potential savings.

- Adjust Your Withholdings: Given the potential changes in tax brackets and standard deductions, consider adjusting your withholdings accordingly. This adjustment can prevent owing a large sum at tax time.

Potential Pitfalls to Avoid

While preparing for tax changes, it’s equally important to be aware of common pitfalls that can arise:

- Neglecting Tax Credits: Many taxpayers overlook available tax credits. Researching and applying for these credits can significantly reduce your tax burden.

- Procrastination: Waiting until the last minute to file your taxes can lead to mistakes. Start gathering documents early and consider using tax software or a professional to streamline the process.

- Ignoring State Taxes: Federal tax changes may not be mirrored at the state level. Ensure you are informed about your state’s tax laws and any changes that could impact you.

Understanding the Implications of Tax Changes

It’s crucial to understand how the changes will impact various segments of the population:

- For Individuals: The rise in the standard deduction could benefit many low- to middle-income earners, allowing them to keep more of their hard-earned money.

- For Families: Changes to child tax credits and dependent deductions can provide significant relief for families, making it easier to manage the costs of raising children.

- For Business Owners: Adjustments in business expense deductions could affect profitability. Staying abreast of these changes is vital for effective financial planning.

Leveraging Technology for Tax Preparation

In today’s digital age, leveraging technology can simplify your tax preparation process:

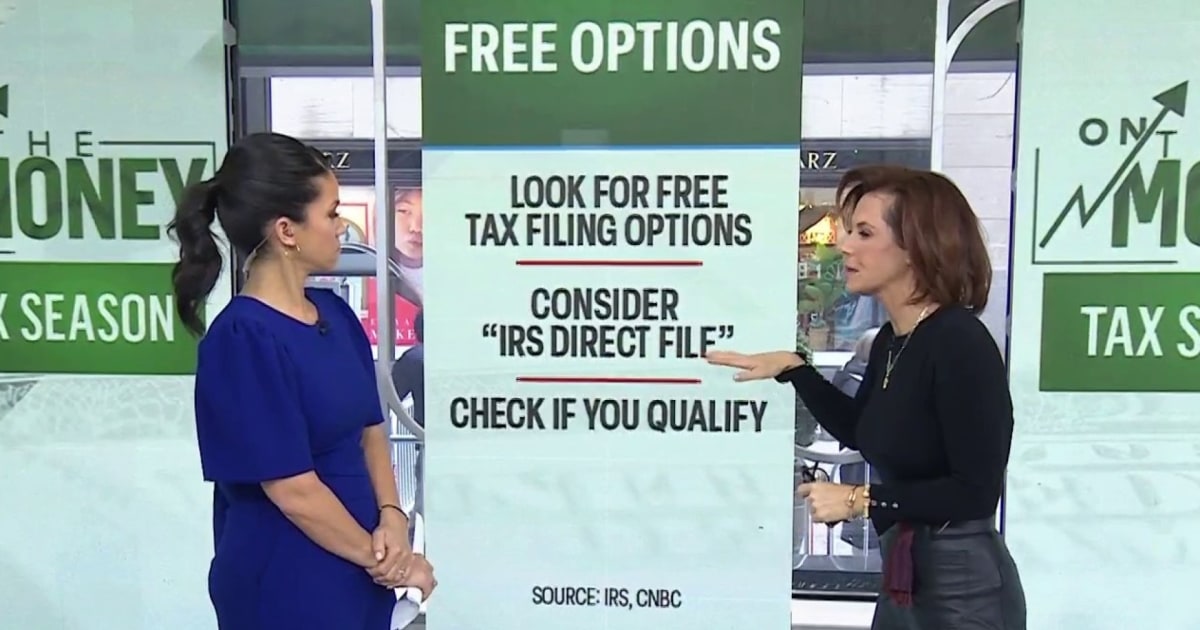

- Tax Software: Consider using reputable tax software that can guide you through the changes and help maximize your deductions and credits.

- Online Resources: Utilize online resources and forums where tax professionals and experienced taxpayers share advice and insights about navigating tax changes.

- Mobile Apps: Many mobile applications can help track expenses and organize receipts, making it easier to prepare for tax season.

Looking Ahead: The Future of Taxation Beyond 2025

While the focus is on the changes for 2025, it’s essential to consider the long-term implications of tax reforms:

- Ongoing Reforms: Tax laws are continuously evolving. Upcoming elections may bring about further changes, so staying informed about political discussions around taxation can be beneficial.

- Global Tax Trends: With globalization, understanding international tax laws and agreements can provide insights into how domestic changes may align with global trends.

- Financial Education: As tax laws change, increasing your financial literacy can empower you to make better decisions regarding investments, savings, and tax strategies.

Conclusion

As we prepare for the tax landscape of 2025, being informed and proactive is crucial. Understanding the upcoming tax changes, preparing your financial situation, and avoiding common pitfalls can make a world of difference. By leveraging technology and consulting professionals, you can navigate these changes with confidence. Remember, preparation is not just about surviving tax season; it’s about thriving financially in the face of change. Stay informed, be proactive, and let the changes work in your favor.

See more CNBC Network