The stock market has been buzzing lately with Eli Lilly’s impressive performance, as the pharmaceutical giant experiences a significant surge in its stock price. This surge has garnered attention not only from investors but also from financial analysts, with some pointing to two groundbreaking developments that have the potential to transform the company’s future. In this article, we take a closer look at what has driven Eli Lilly’s recent stock growth, the game-changing updates that are making waves, and why financial expert Jim Cramer is so optimistic about the company’s prospects.

Eli Lilly’s Stock Surge: What’s Driving the Momentum?

Eli Lilly (NYSE: LLY), one of the world’s largest pharmaceutical companies, has seen its stock price rise sharply in recent months. While stock movements are often influenced by various factors, the recent uptick in Eli Lilly’s share price can be largely attributed to two major developments: groundbreaking advancements in its drug pipeline and a shift in investor sentiment toward biotech stocks.

The Impact of Eli Lilly’s Breakthrough Diabetes Drug

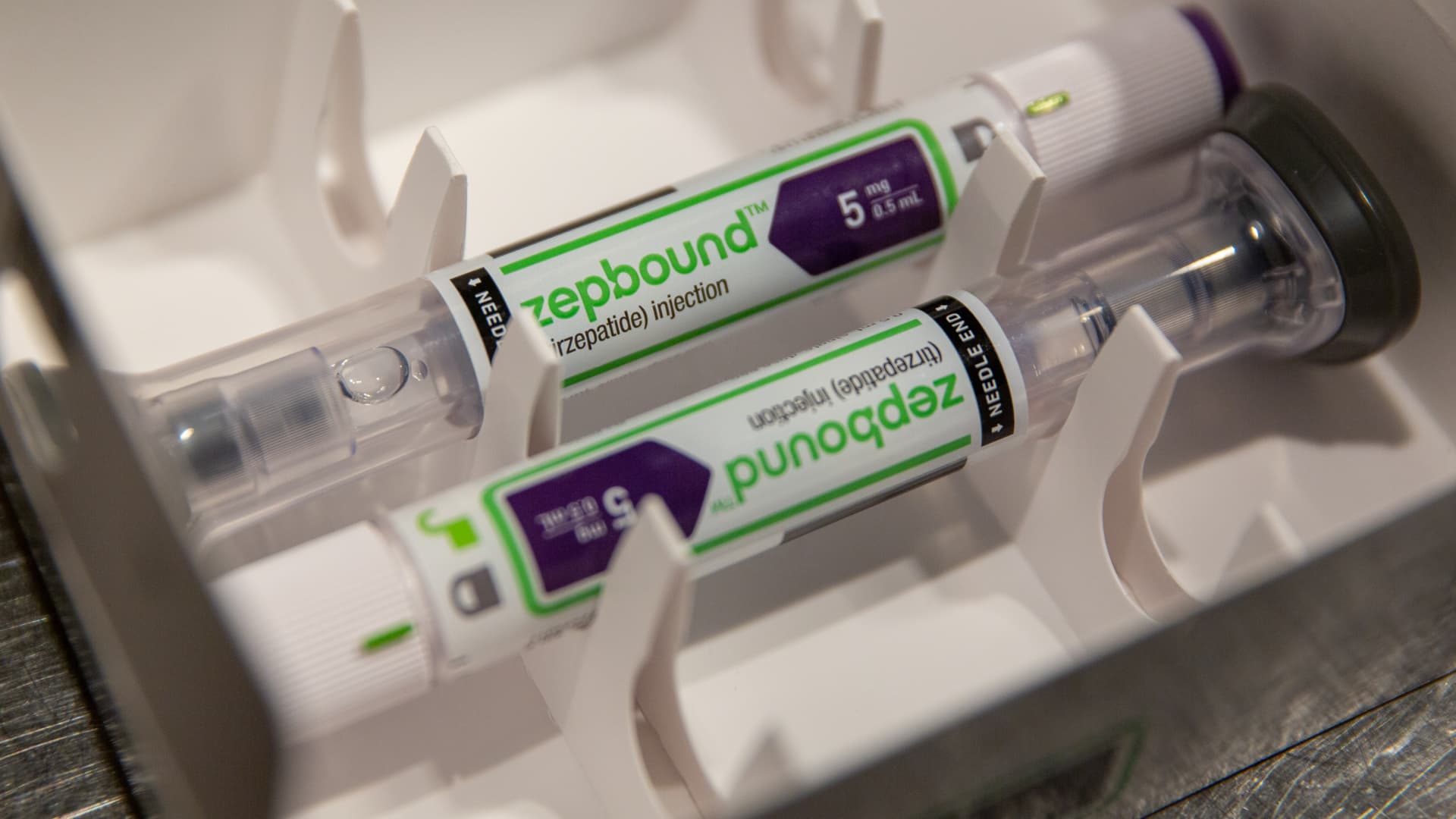

At the heart of Eli Lilly’s stock rally is its highly anticipated drug, Mounjaro, which has shown incredible promise in the treatment of type 2 diabetes. Mounjaro (tirzepatide) is a once-weekly injection that works by mimicking two hormones involved in blood sugar regulation, making it more effective than traditional treatments. Early clinical trial results have demonstrated that Mounjaro not only controls blood sugar levels better than current diabetes medications but also has the added benefit of aiding in weight loss, a critical issue for many diabetic patients.

The FDA’s approval of Mounjaro for the treatment of type 2 diabetes in 2022 was a major milestone for Eli Lilly. Since then, the drug has seen robust sales, with analysts projecting that Mounjaro could generate billions in annual revenue once it expands its indications to include obesity treatment. In fact, recent reports suggest that Mounjaro may become the most lucrative drug in Eli Lilly’s portfolio, potentially surpassing even the company’s widely successful insulin products like Humalog.

Positive Trial Results and Expansion Into Obesity Treatment

Beyond diabetes, Mounjaro is also under investigation for its effectiveness in treating obesity, a condition affecting millions worldwide. The company has launched a series of clinical trials aimed at securing FDA approval for Mounjaro as a treatment for weight loss, and early results have been overwhelmingly positive. If successful, Eli Lilly stands to capitalize on the growing global demand for obesity treatments, a market that could be worth tens of billions of dollars in the coming years.

As the fight against obesity becomes a central focus of the healthcare industry, Eli Lilly’s position as a leader in this space could further solidify its market dominance, creating a strong growth catalyst for its stock in the long term.

Jim Cramer’s Endorsement: A Sign of Confidence

Famed financial expert Jim Cramer has been vocal in his support for Eli Lilly, expressing his belief that the company’s stock could continue to outperform the market. Cramer, known for his popular CNBC show “Mad Money,” has pointed to Eli Lilly’s impressive growth prospects, especially in the diabetes and obesity treatment markets. His endorsement of the stock has brought additional attention from retail and institutional investors alike, further fueling the stock’s upward momentum.

Cramer’s analysis highlights Eli Lilly’s consistent ability to innovate and its strong position in the healthcare sector. Given the company’s leadership in key therapeutic areas and its potential to reshape the market for diabetes and obesity treatments, Cramer believes that Eli Lilly is poised for significant long-term success. His confidence has, no doubt, contributed to the bullish sentiment surrounding the stock.

Broader Implications: The Future of Biotech and Healthcare Innovation

The surge in Eli Lilly’s stock comes at a time when biotech and pharmaceutical stocks are experiencing increased investor interest. This is partly driven by the rapid advances in medical science, particularly in the areas of personalized medicine, gene therapy, and chronic disease management. Investors are keenly aware of the potential for breakthrough therapies to revolutionize treatment paradigms, and companies like Eli Lilly that are at the forefront of these innovations are benefiting from the attention.

The Growing Obesity Treatment Market

One of the key trends that investors are watching closely is the explosion of the obesity treatment market. According to recent estimates, the global obesity treatment market could exceed $30 billion by the end of the decade. This growing demand is a direct response to the increasing prevalence of obesity-related health conditions, such as heart disease, diabetes, and certain cancers. As a result, drugs like Mounjaro that target both obesity and diabetes are seen as potential blockbusters, positioning Eli Lilly to capture a substantial share of this lucrative market.

In addition to Mounjaro, Eli Lilly has a deep pipeline of drugs targeting various chronic conditions, including rheumatoid arthritis, cancer, and Alzheimer’s disease. The company’s diverse portfolio further strengthens its position in the market and provides a solid foundation for continued growth, especially as the global population ages and the demand for treatments for chronic conditions increases.

The Risks of Overdependence on a Single Drug

While Eli Lilly’s prospects look promising, it’s important to note that there are inherent risks in becoming overly reliant on a single drug, such as Mounjaro. The success of Mounjaro will play a crucial role in determining the company’s financial trajectory over the next few years, but the company’s future performance could be impacted if competition in the diabetes and obesity treatment markets intensifies or if regulatory hurdles arise. Additionally, healthcare pricing pressures and public policy changes related to drug costs could also affect Eli Lilly’s bottom line.

That said, Eli Lilly’s robust pipeline and diversified portfolio help mitigate some of these risks, making it a more resilient player in the competitive pharmaceutical landscape.

Conclusion: Eli Lilly’s Bright Future and Stock Performance

Eli Lilly’s recent stock surge is a reflection of the company’s strong fundamentals, innovative drug pipeline, and market leadership in key therapeutic areas. The success of Mounjaro in treating diabetes and its potential for expansion into obesity treatment has set the stage for continued growth, attracting the attention of investors and analysts alike. Jim Cramer’s endorsement of Eli Lilly further underscores the company’s bright future, as the broader healthcare market continues to evolve and present new opportunities.

As Eli Lilly continues to innovate and deliver groundbreaking treatments, its stock is likely to remain a strong performer in the biotech sector. However, investors should stay mindful of the risks involved, including regulatory challenges and competitive pressures, while keeping an eye on the company’s ongoing advancements. With a strong portfolio and a commitment to improving patient outcomes, Eli Lilly appears well-positioned to maintain its leadership role in the healthcare industry for years to come.

For more insights on pharmaceutical stocks and healthcare innovation, visit BBC Health and learn about the latest developments in the field.

See more CNBC Network